Cocoa Summary Fact Sheet

Production

- Eastern

- Ashanti

- Central

- Western

- Western North

- Ahafo

- Bono

- Oti and

- Volta

- 2.6 Million Ha

Fluctuates annually between 20% and 30%.

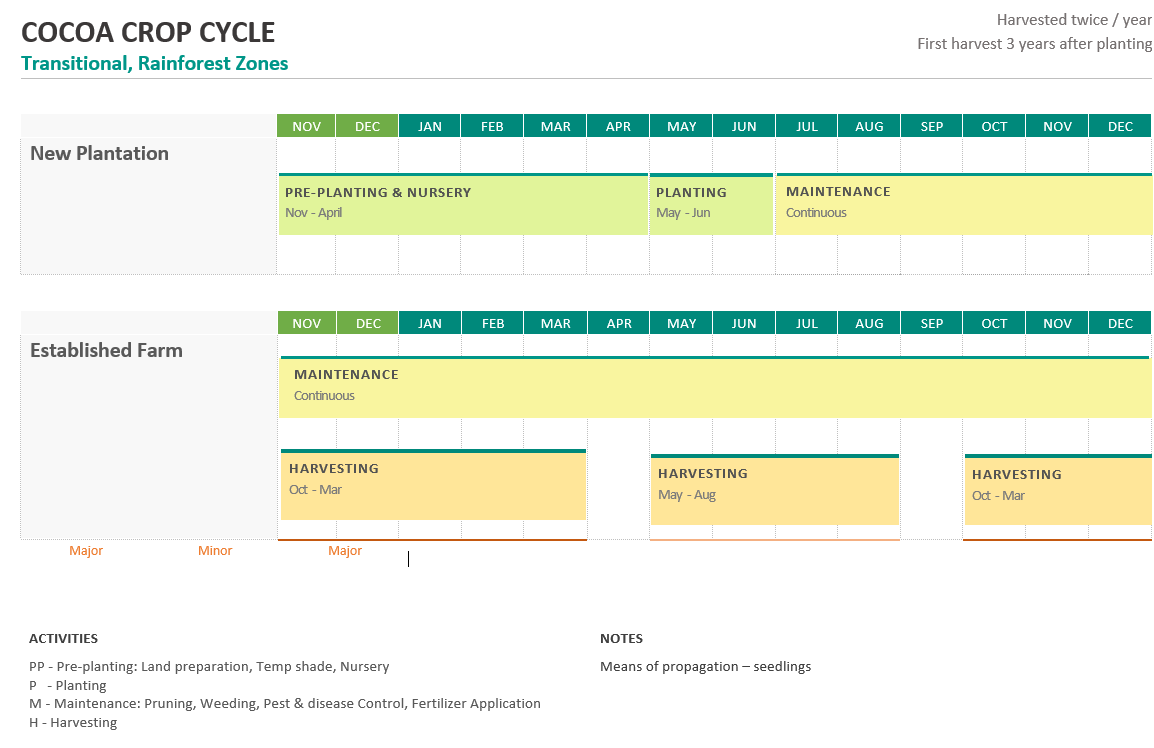

- 1 - 4 years – Juvenile stage

- 5 to 30 years productive stage

- Hybrids produce early from 3 years

- Major harvest season: October to March

- Minor harvest season: May to July

- May to July (Transplanting should be done in the middle of the rainy season or when rainfall is expected to ensure optimum seedling survival).

- 3 m x 3 m Spacing (10 ft x 10 ft). In some areas it is 2.5 by 2.5m. Most smallholder farmers plant at stake or direct seeding (atodwε)

- 1,111 trees using 3 m x 3 m per Ha

- From 5 to 30 years

- Economic pods from 5 years.

- Hybrids produce early from 3 years.

- Peak production period is from 10 to 20 years.

- Yield declines after 20 years

- Major season: October to May

- Minor season: June to August

- Kilogramme

- Standard bag of cocoa is 64 kg at farm gate,

- Export weight is 62.5kg

- 8.2% to agricultural gross domestic product (GDP).

- Averagely 850,000 tons annually

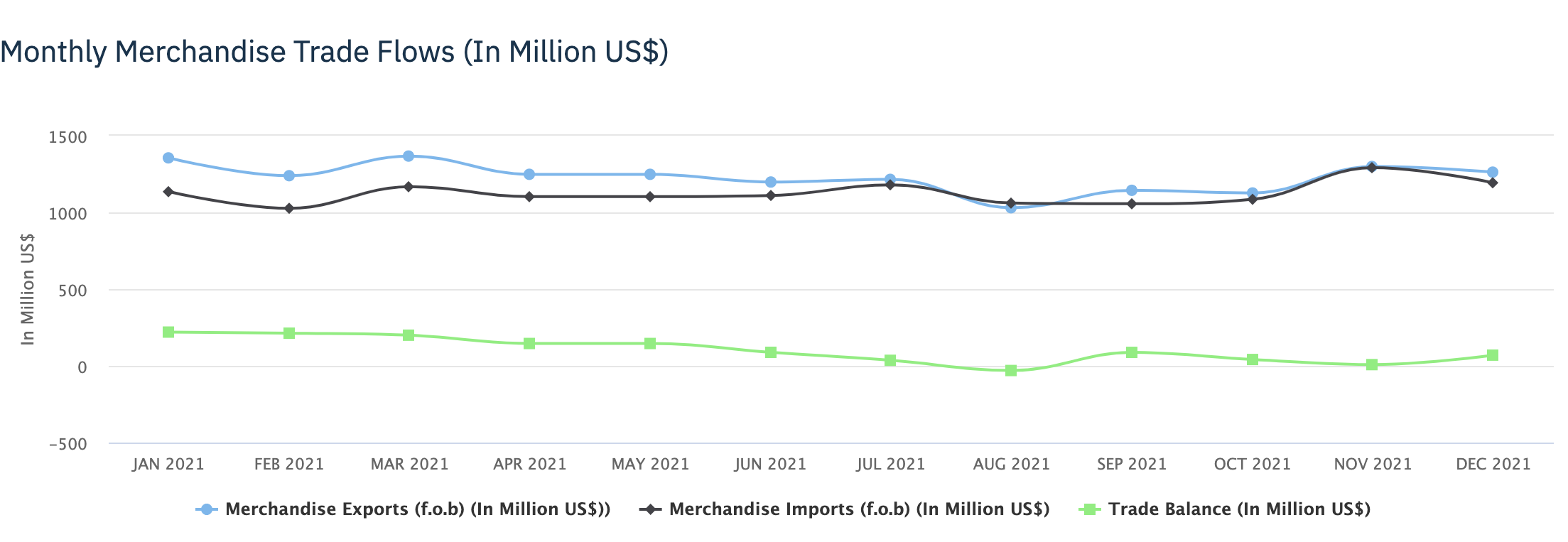

Market & Trade

- 70% of Global Cocoa Export Comes from Cote d'Ivoire and Ghana.

- Major harvesting Season: October to March

- Minor Season: May to August

- GH ¢ 53.00 per bag (GH ¢ 850/Mt) - 2001 / 2002

- GH ¢ 515.00 per bag (GH¢ 8,240/Mt) - 2019 / 2020

Processing

40%

- COCOBOD mostly sell light crop beans (minor season) for domestic processing at a discount.

- About 32% of total national output is processed domestically

- 499,100 tons per year.

- 13 Major Domestic Processing Companies

- 33% Ghanaian

- 17% joint venture

- 50% foreign-owned

Productivity

- Supports 800,000 smallholder households

- 450 Kg/Ha

- 700 Kg/Ha. (Range of 600 to 1,000 Kg/Ha – CLP, ACI and company programme)

- 1,000 Kg/Ha

- 1,500 Kg/Ha

- 0.63 Kg (Assuming 25 pods per tree and 25 beans per pod)

Yield: 700kg/ha

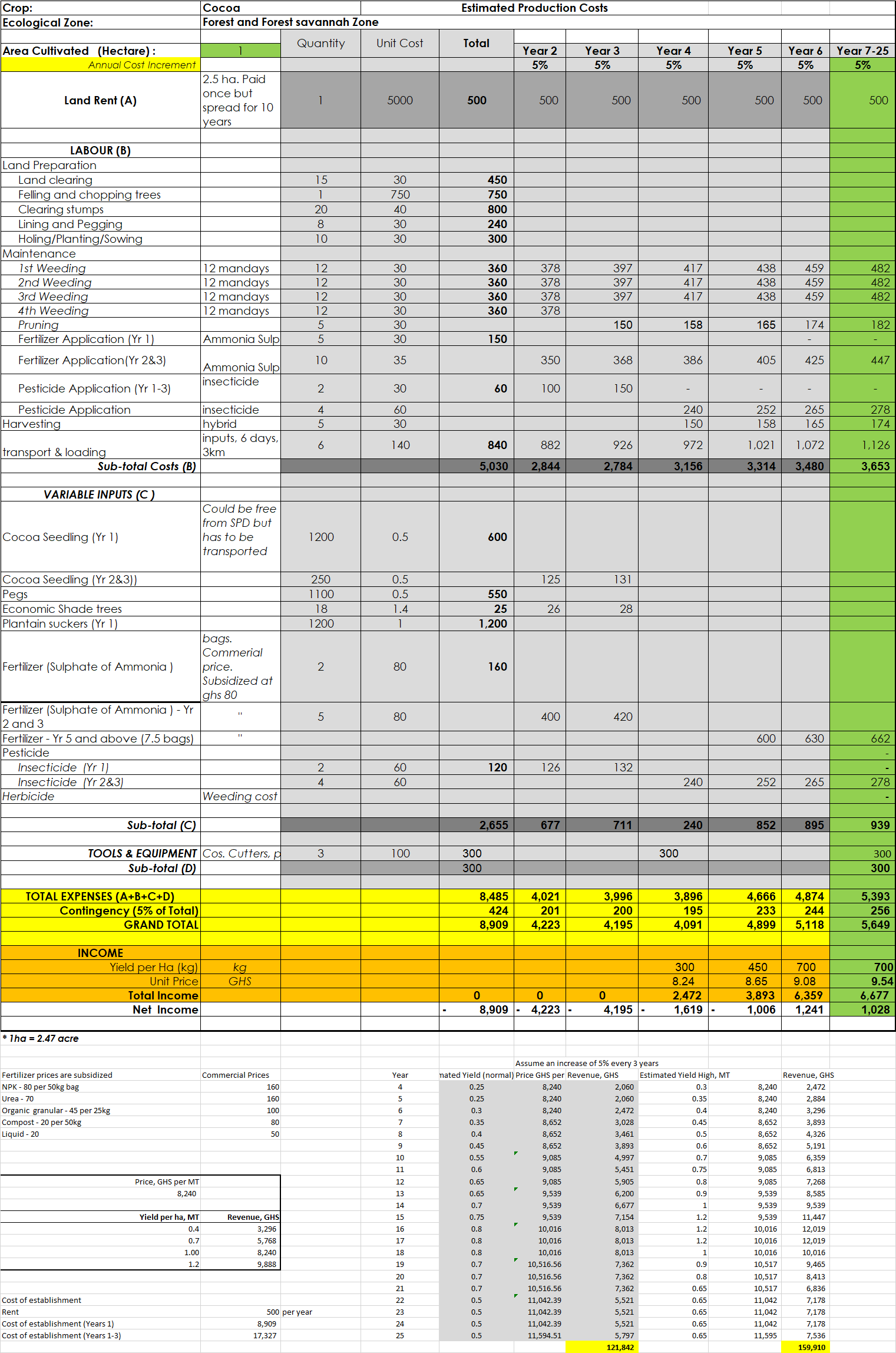

Budget Benchmarks

- GH ¢ 122,000 to GH ¢ 160,000

- Current yield levels (4 - 25 yrs) – GH¢ 122,000

- Higher yield levels (4 - 25 yrs) – GH¢ 160,000

*Assume producer price to increase by 5% every 3 years.

- $ 700.00 per Ha per season

Risks

- Poor Crop Yield which will reduce supply.

- Quality Control management.

- Congestion along the Supply Value Chain

- Cocoa Price Volatility.

- High Interest Rates for facilities.

- Exchange Rate Volatility.

- Diversion of Produce/Smuggling

___

General Overview of Cocoa Production

Cocoa (Theobroma cacao) is a native of Brazil and the Amazon and grows well around the equator. West African countries of Cote d'Ivoire and Ghana produce and export over 60% of the global cocoa. Other origin countries are Nigeria, Cameroon, Togo, Indonesia, and South American countries of Ecuador, Peru and Columbia.

Ghana’s cocoa, over the years, has been regarded as premium quality due to several factors. The adoption and adherence to Good Agronomic Practices (GAPs), regular training offered to farmers and the immense roles played by stakeholders towards ensuring the country’s multi-billion-dollar industry is sustained. COCOBOD, through its relevant subsidiaries, implements programmes to support Pre-harvest and Post-harvest activities that constantly promote the quality of the cocoa beans the country produces to feed the world’s confectionery and pharmaceutical markets.

Two main post-harvest activities are key; the natural means of fermenting and drying cocoa beans have helped to keep the country’s niche in delivering premium quality cocoa. However, Good fermentation of Ghana’s cocoa has unarguably remained the cardinal reason for which the country’s beans have become the benchmark for measuring cocoa worldwide. Generally, the country’s position as the leading producer of premium quality cocoa attracts a country origin of price.

The cocoa industry has been the mainstay of Ghana’s economy for about a century, contributing 8.2% of GDP. The contribution of the cocoa industry to the Ghanaian economy is significant, employing approximately 850,000 farm families and generating more than $2 billion annually through foreign exchange of export crops.

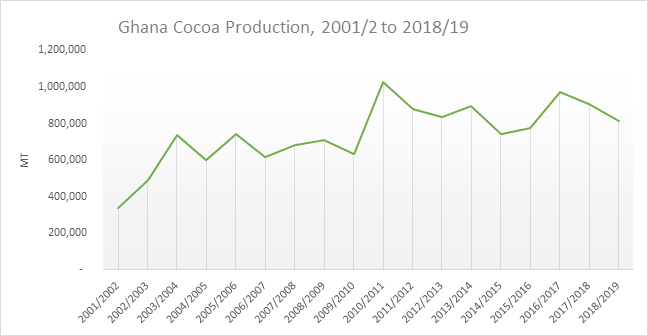

Cocoa production is in the hands of smallholders with an average farm size of 2.5ha with average productivity of 450kg/ha. Project assisted farmers have achieved on average 700kg/ha and pollinated farms have achieved between 1,000 and 1,500kg/ha. Average production of cocoa in Ghana for the last 5 years is around 850,000 MT from about 1 million cocoa family households and indirectly employing another 1 million Ghanaians. Ghana attained 1.1 million metric tonnes during the 2020/21 crop season.

According to the Bank of Ghana, Exports of cocoa beans and products surged by 1.7% to US$2.33 billion in 2020. Cocoa beans exported amounted to US$1.48 billion, an increase of 2.0 percent year-on-year. The average realised price increased by 6.8 per cent to US$2,527.33 per tonne, while export volume fell by 4.5 per cent to 585,679 tonnes. Earnings from cocoa products increased by 1.3 per cent to US$0.85 billion, on account of a 4.0 per cent increase in the average realised price, which settled at US$3,102.27 per metric tonne at end-December 2020. Volume fell by 2.6 per cent to 273,334 metric tonnes. The demand for certified cocoa by the world’s top chocolate producers positively influenced the price of the bean in 2020.

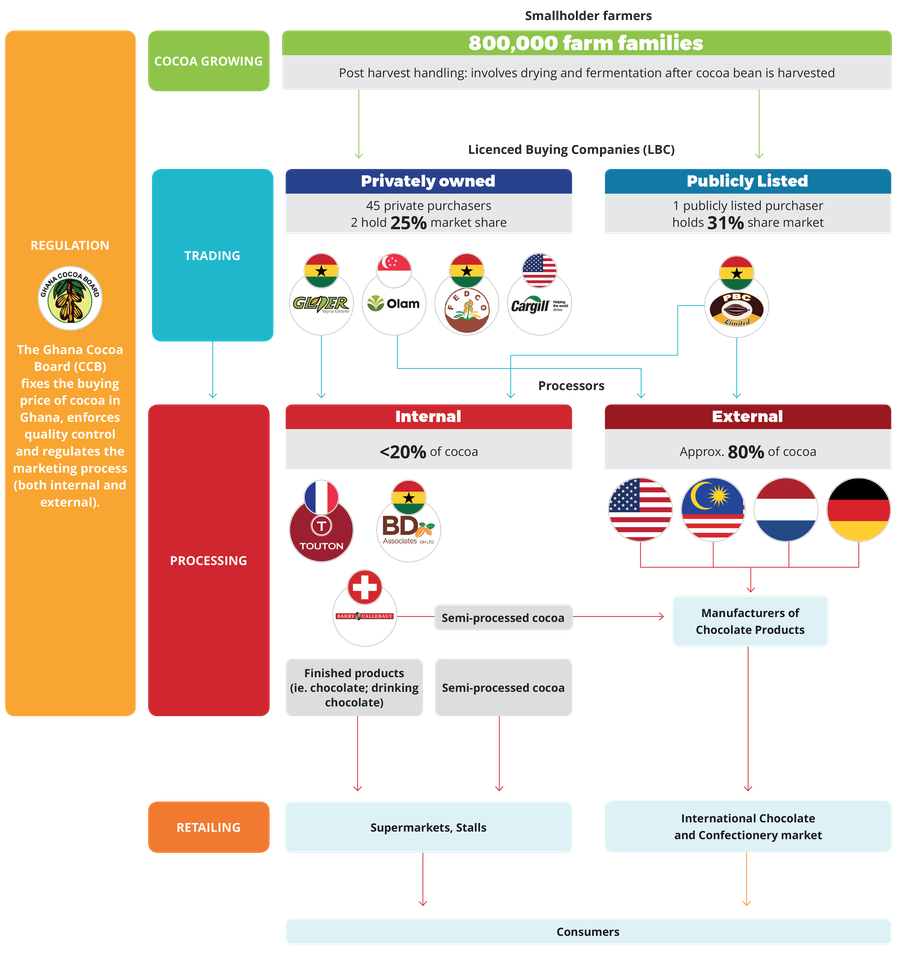

Government through the Ghana Cocoa Board (COCOBOD) supports farmers and regulates the sector especially setting of producer prices, marketing, and exports. The value chain involves input provision including planting material, production (nursery and field), marketing (local and exports of raw cocoa beans), processing (intermediate products such as butter, cocoa powder and ready to eat chocolate and other confectionery products).

Generally, there are two cocoa populations, Criollo and Forastero. Trinitario, a hybrid of the other two, is considered as the third population. The type planted in Ghana is of the Forastero group. It was first introduced in 1815 and 1843 by the Dutch and Swiss, respectively, but failed to survive. Later in 1879, a Ghanaian, Tetteh Quarshie, successfully started a cocoa farm and raised about 300 trees by 1890.

| Variety | Characteristics |

| Criollo |

This is a very high quality cocoa bean and is very aromatic and lacks bitterness. The Criollo is used in luxury chocolate but rarely alone since it is very scarce and expensive. Becoming less and less available The word means 'stranger' or 'outsider' in Spanish. Ordinary, everyday cocoa with strong, earthy flavours. Found in Ghana, Nigeria, Ivory Coast, New Guinea, Brazil, Central America, Sri Lanka, Malaysia and Indonesia. Represents about 85% of the world's cocoa production.

|

| Forastero |  The Forastero tree usually has 30 to 40 cocoa beans per pod. It can be recognized by its smooth, yellow and green pods with a strong, acidic aroma. Its beans contain a high concentration of tannin. The beneficial characteristics of Forastero encouraged farmers to expand their plantation. Thus, this cocoa group now accounts for nearly 80% of world production. Due to its high profitability, the Forastero cocoa crop could expand further around the world. |

| Trinitario |  The pods’ shapes, the bean color and the plant size varies according to Trinitario subspecies. With pods that are red and turn orange at maturity, the Trinitario cocoa tree seduces the big producers because of its resistance and unparalleled flavor. Production of Trinitario cocoa trees represents 5% to 10% of world cocoa production. 150 pods per Trinitario plant are harvested in one year of production, equivalent to an average of 6 kg of cocoa. |

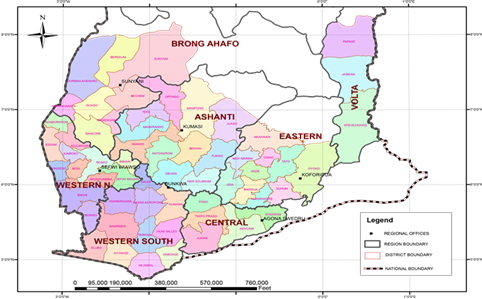

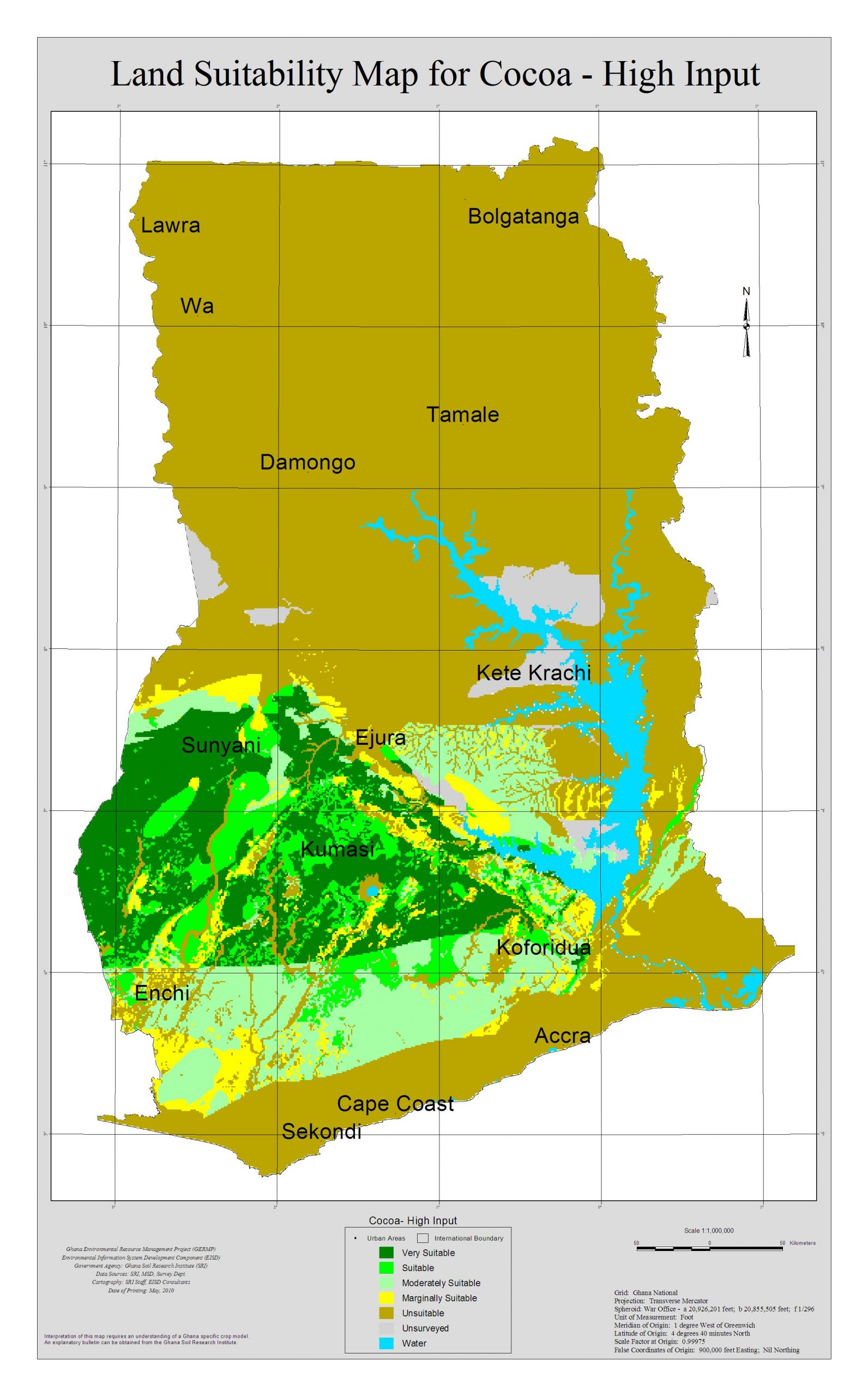

Cocoa growing regions are Western North, Western, Ashanti, Eastern, Central, Ahafo. Others include Brong Ahafo, Bono East, Oti and Volta region. The six (6) major cocoa regions are Ashanti, Eastern, Western South, Brong Ahafo, Volta and Central Region, of the 6 regions, Western North is noted for producing about 40% of Ghana's cocoa stock.

COCOBOD CHED Operational Districts

KEY PLAYERS IN GHANA'S COCOA SECTOR

As part of efforts to increase local value addition and tap into growing global demand for cocoa, investment from both local and international players in processing facilities has gathered pace in recent years. Ghana’s Afrotropic Cocoa Processing commissioned a new cocoa processing factory in 2019 in an investment valued at $30 million. In November 2021, Cargill completed the $13 million expansion of its cocoa processing plant in Tema, bolstering its annual production capacity to 90,000 tonnes. Most recently, in May 2022, Koa, a Swiss-Ghanaian start-up, received a $3.5 million investment from the Landscape Resilience Fund, which mobilises finance for communities, conservation, and commerce, and the IDH Farmfit Fund – a Utrecht-based Sustainable Trade Initiative that promotes sustainable trade – to build a new cocoa processing facility. These investments support Ghana’s ambitions to reshape its role in the global cocoa market and retain more value from its leading commodity crop.

Cocoa Production

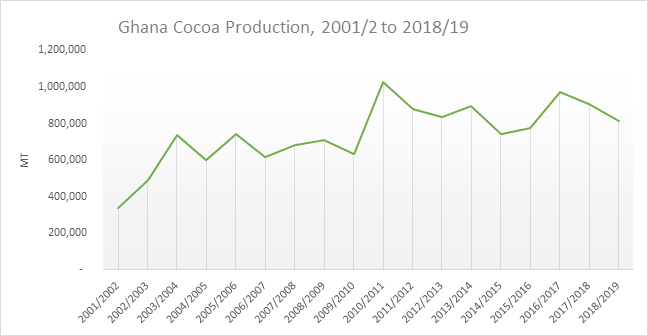

Figure 1:Cocoa Production from 2001/2 to 2018/19

Investment Opportunities

- Input manufacturing and distribution – Crop protection and phytosanitary products, fertilizer (inorganic and organic), tools and equipment such as pruners, slashers. Government of Ghana’s strategy is to increase private sector participation in input Delivery. Ghana has many such private companies that import or manufacture pesticides or blend fertilizers for the cocoa sector. Such companies include RMG, Chemico and Yara.

- Nursery establishment and management – COCOBOD has seed production stations and is charged to produce cocoa seedlings for farmers to rehabilitate and plant new farms. The demand for cocoa seedlings far outweighs the supply and private companies such as Tree Global has invested in technology that allows them to produce cocoa seedlings and sell to farmers at subsided prices by cocoa companies.

- Technology and innovations – GIS mapping, database design, farmer database and geo-referencing, drone for spraying, irrigation, dual-purpose pruners, etc

- Service provision – professional farm maintenance including spray gangs, hauling, private extension training and delivery.

- Cocoa Farming – with access to arable land, a farmer can obtain a gross margin of between $520 to $600 per annum (only variable cost is netted out for productive farms with matured trees).

- Value addition through processing – i) Primary processing: Liquor, butter, cake and powder; ii) Secondary processing: Liquid chocolate or coating (coverture); and iii) Tertiary processing: Finished chocolate or Confectionery products.

___

Value Chain Mapping and Key Actors

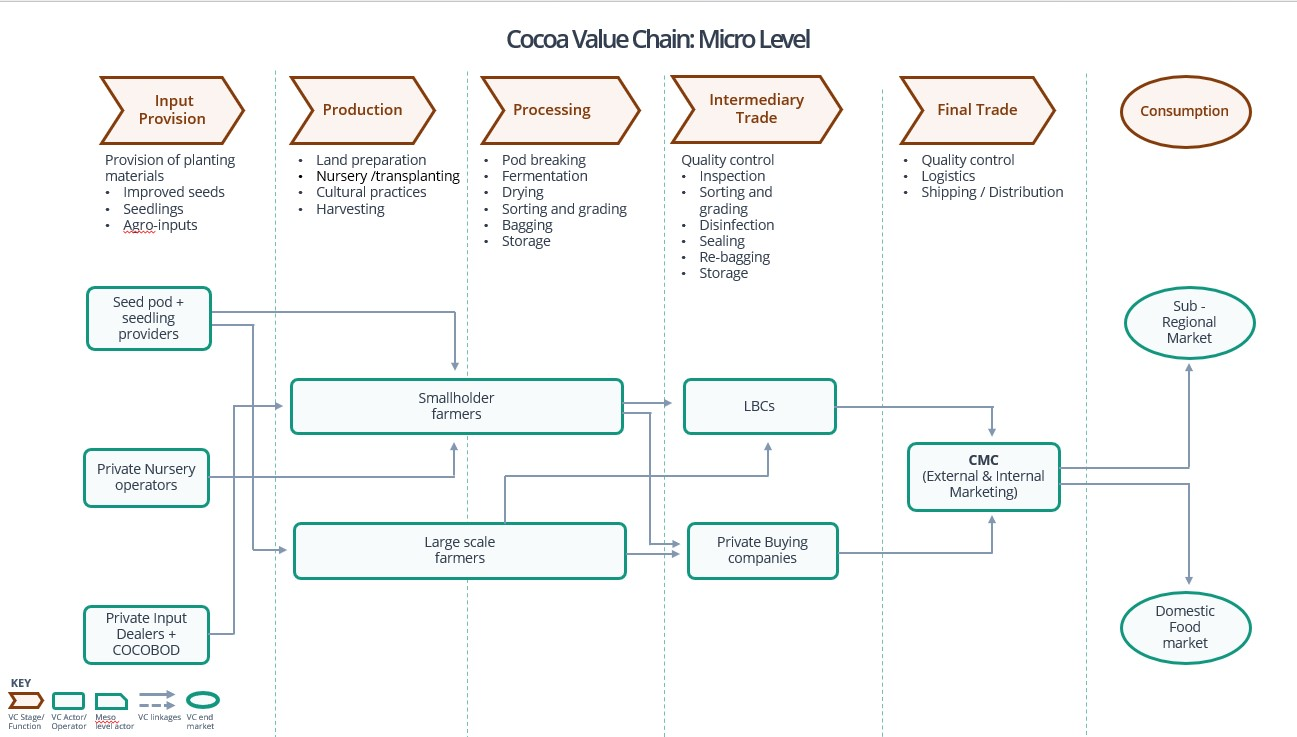

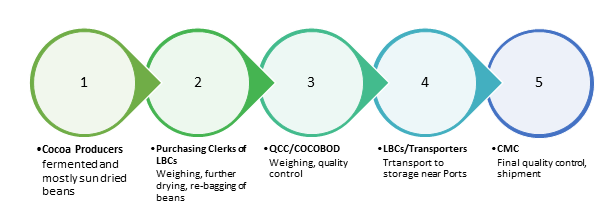

Cocoa Value Chain Linkage

The key actors in the cocoa industry include upstream stakeholders - farmers, input suppliers, with support from COCOBOD units such as Cocoa Research Institute of Ghana (CRIG), Seed Production Division (SPD) and Cocoa Health and Extension Division (CHED). There are private sector companies and NGOs that provide a private extension to farmers directly. The downstream actors include buyers and traders including licensed buying companies (LBCs), both local and foreign processors and exporters with support from COCOBOD divisions such as Quality Control Company (QCC) and Cocoa Marketing Company (CMC) and M&E.

Input Provision and Suppliers

Some of the main inputs are planting material, inorganic fertilizers, organic fertilizers, pesticides (fungicides and pesticides), boots, and tools (slashers, pruners and sprayers). The main actors here are COCOBOD/SPD, CHED and CRIG for planting material including cocoa seed pods for private nurseries at communities or by companies. Input dealers include Chemico, RMG, Agrimat, Desert Lion, OmniFert, Yara, and OCP. COCOBOD provides fertilizers, pesticides, tools and equipment at subsidized prices to farmers through the farmer associations.

Production

Mostly in the hands of smallholder farmers in cocoa-growing regions that operate individually or are in community farmer groups and cooperative societies and unions. There are very few large scale cocoa farmers in Ghana. Cocoa is grown and harvested by farmers who ferment and dry the cocoa beans before sale to the LBCs. CHED provides extension service to farmers complemented by private companies, including some License Buying Companies (LBCs) and NGOs.

Trade

Cocoa farmers sell cocoa to purchasing clerks of Licensed Buying Companies (LBCs) and private buyers and traders such as ECOM, Olam, KooKoo Pa, Produce Buying Company (PBC), Federated Commodities, Kuapa Kokoo, Adwumapa Buyers etc. Quality control starts with farmers and purchasing clerks of LBCs, before they are sent to the Quality Control Company (QCC).

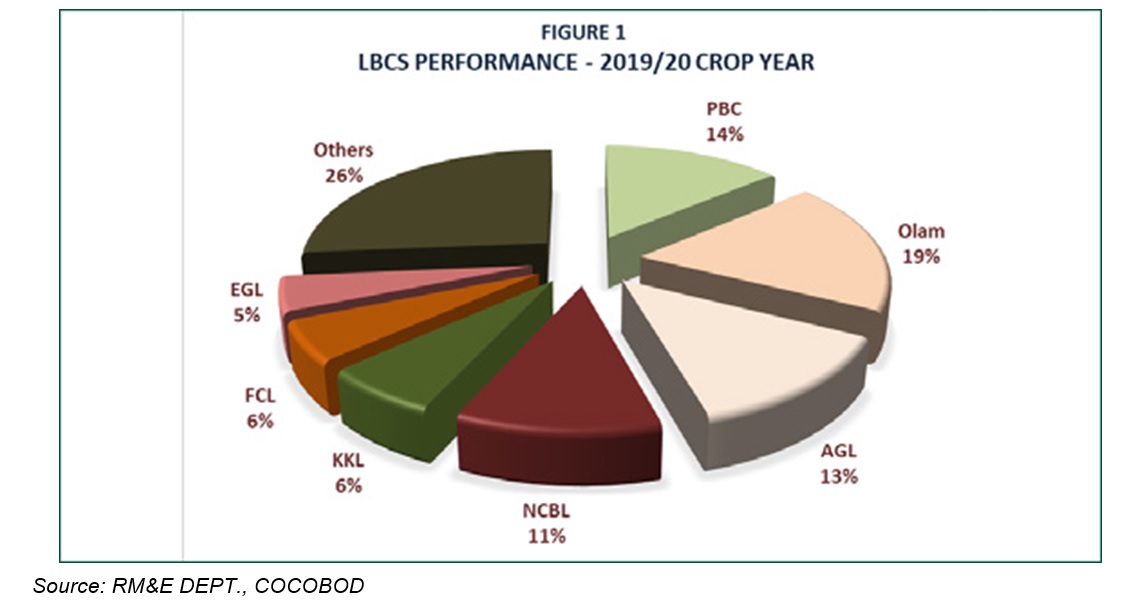

During the 2019/20 season, 55 LBCs were licenced to engage in the internal marketing of cocoa. However, only 38 active LBCs purchased cocoa during the year. Cocoa purchased for 2019/20 season was 770,694 tonnes which shows a decrease of 5.06%, compared to the 811,747 tonnes recorded in 2018/19 crop year. Out of the 55 LBCs, 38 were actively involved in the internal marketing of cocoa during 2019/2020 season.

Olam Cocoa Ltd (Olam) led the pack of active LBCs with 19% share of the market. Produce Buying Company, Agroecom Ghana Ltd. and Nyonkopa Comm. Buyers Limited followed in second, third and fourth places with market shares of 14%, 13% and 11% respectively. The remaining thirty four (34) companies together accounted for 43% of the market. The performance of the respective LBCs during the season under review is shown in Figure 1.

The post-harvest sector functions are undertaken by the Quality Control Company (QCC) Limited and the Cocoa Marketing Company (CMC) Ghana Limited. The QCC is responsible for the inspection, grading, and sealing of cocoa for the local and international markets and also responsible for the disinfestation of produce. The CMC performs the external marketing function of the COCOBOD as well as the takeover function within the internal marketing system.

Regarding logistics, the hauliers/transporters bring cocoa from each cocoa district to storage warehouses in Takoradi, Accra and Tema. There are also jute sack manufacturers and shipping lines that handle cocoa shipment to Europe with CMC.

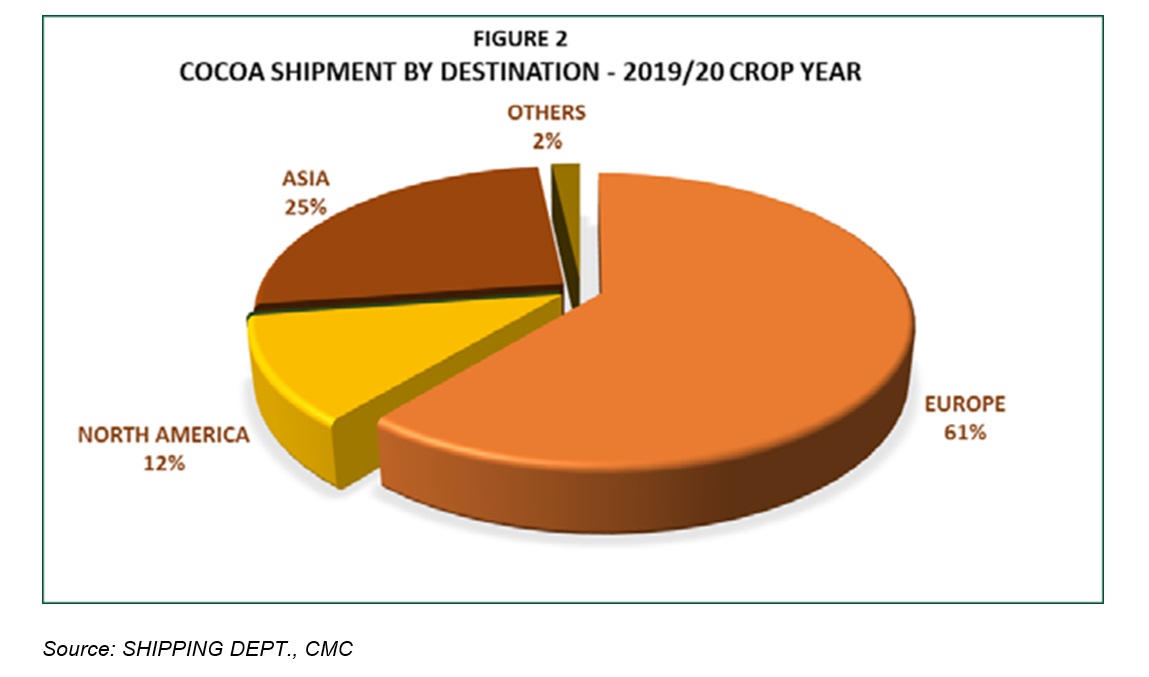

Cocoa beans shipped to overseas destinations during the 2019/20 crop year totalled 501,942 tonnes. The sale value of the beans shipped amounted to US$1,273,177,250.00. The European Union continued to be the destination receiving the largest shipment of Ghana cocoa beans. Shipment of cocoa to the Europe Union accounted for 61% of total cocoa beans exported. The direction of trade for bean shipments is shown in Figure 2

Processing

Some of the major processing companies are Cocoa Processing Company (CPC), Niche, Cargill, Barry Callebaut, Touton, and Olam. Over 80% of beans purchased by the LBCs is shipped abroad in raw form, meaning value is added in other markets. Asoko has mapped nine companies responsible for processing the remaining 20% of cocoa domestically. This processing is largely limited to the production of semi-finished goods, which are then exported or consumed locally. The processing segment is dominated by three multinationals (Cargill, Barry Callebaut and Olam) with a combined market share of 71%.

Consumption

In 2022 per capita consumption of cocoa products in Ghana stands at 1kg, a rise from 2017’s figure of 0.50kg.

Figure 3: Cocoa Value Chain

___

Key Agronomic Practices

Key Agronomic Practices and their Importance

| Practice | Brief Description and Importance |

|---|---|

| Planting Material | Hybrid. Other older varieties are forastero, criollo, trinitario |

| Nursery Establishment | The nursery is a site where cocoa seedlings are raised for transplanting to the field. Nursery operations should start between November and December. Can be done using the seed bed or polythene bag method. The period for developing matured seedlings from seed is about 6 months. |

| Choose suitable soils | Soil texture with good-water-retaining properties but must also have good drainage and aeration. The most preferred soils are loam or clayey loam. Must be at least 1.5 m deep, this is particularly important if there is insufficient or poorly distributed rainfall. The soil structure must be as homogenous as possible to allow roots to penetrate easily. The soil must be rich in nutrients with pH of 5 – 8. Soils with high organic matter content in the top soil topsoil (about 3.5% in the top 15 cm) are most preferable. |

| Agro Climatic conditions | Between 1,500 mm - 2,000 mm and a dry season of not more than three months with less than 100mm rain per month are preferred. Cocoa thrives in areas with maximum temperatures ranging between 30 - 32 °C and minimum 18 - 21 °C. Cocoa thrives in areas with a relative humidity of 100% at night and about 70 - 80 % during the day. |

| Shade Management | Use a temporary shade of palm fronds for raising seedlings, plantain, Gliricidia sp and cassava for juvenile cocoa seedlings and permanent shade of 40 - 60% for matured cocoa trees. Establish temporary shade 6 months before planting of cocoa seedlings. |

| Pruning | Remove all unwanted and diseased branches and parts such as chupons, dead and drooping branches and mistletoe. Three types of pruning are practiced - formation (adjust the height of the first jorquette/branching and create the desired shape during establishment), sanitary (remove diseased or unnecessary branches) and structural pruning (to shape the canopy to desired size and architecture). This should be done before the onset of the rainy season. |

| Pest and Disease Management | Use appropriate pesticides, thinning and pruning to control sucking pests, stem borers and anthracnose (Colletotrichum sp). Bacterial leaf spot disease is a big challenge in Ghana. Combine good sanitary measures, pruning, harvesting and application of pesticides to control it. |

Soil Fertility Management

| Soil fertility refers to the capacity of the soil to supply nutrients to the plant. Reduce soil erosion, replenish with recommended macro and micronutrients and improve organic matter content. Add conventionally (Conventional fertilizers are applied to the soil either by broadcasting under cocoa trees or as rings under cocoa trees once a year. The best time of application is the beginning of the main rains, April/May); Foliar or Organic considering site-specific needs. Young cocoa requires 70g of Ammonium Phosphate, matured trees required NPK in various formulations and other nutrients for fertilizer ready farms (3 bags per acre). |

| Weed Management | Weed control in cocoa farms reduces competition with cocoa for nutrients, water and light. It also reduces the incidence of insect pests and rodents that attack the plants and makes the farm less humid and clean which decreases the incidence of the black pod disease. Glyphosate at a dosage of 1.5 - 2 litres per hectare (225 - 300 ml) per 15 litre pneumatic knapsack is recommended for weed control in cocoa. |

| Harvest Management | Generally, there are two crop seasons of cocoa within a year, the main crop in October - March and the mid - crop in May - August. During harvest, do not damage cushions, leave over-ripped pods on trees and separate diseased pods form good ones. |

Post-Harvest practices

| Pod breaking is done by cutting the pods open using blunt cutlasses or wooden clubs and should be done 2 - 3 days after harvesting. Fermentation begins on the same day as pods are broken. The importance of cocoa fermentation is to develop chocolate precursors in the bean. It is normally done in six days and it is caused by microbial succession. Drying begins on the same day fermentation ends. Drying is the reduction of moisture in fermented beans from about 55% to 7.5%. After fermentation, the beans are carried to the drying area and spread thinly on raised mats in the sun. The minimum period of drying is 7 days. |

___

Key Risks Along the Value Chain and Mitigation Measures

| Value Chain Actions | Key Risks and Challenges | Mitigation Measures |

|---|---|---|

| Input Supply | Land Acquisition and Tenure: Settler farmers, managers and potential farmers face risks with repossession of land cultivated over the years. Farmers are not able to fully invest in rehabilitation because of this emerging risk and problem especially in some parts of the Western Region. | The government led by COCOBOD and Ministry of Lands and Natural Resources in conjunction with Chiefs and landowners should invest in mapping all cocoa lands and farms, put in place mechanisms for compensating Chiefs and allow farmers to rejuvenate farms. COCOBOD’s current policy for controlling the Cocoa Swollen Shoot Virus Disease (CSSVD) is to manage the cutting and replanting and compensate owners and farmers. |

| Nursery and Planting Material: Inadequate, diseased and weak cocoa seedlings produced by farmers and the phenomenon of direct seeding results in high mortality rate during farm establishment. | Investment in nurseries and production of vigorous seedlings that are disease-free by Seed Production Division (SPD), communities and private operators. COCOBOD and private sector sustainability programmes need to train, monitor and supervise nurseries. | |

| Fertilizers (Inorganic and Organic): Low access and application of recommended fertilizer due to cost. Waste of fertilizer due to wrong timing and quantity applied. High risk of environmental pollution associated with use of conventional fertilizer. | Invest in soil testing and manufacturing of site-specific fertilizer and trials of cheaper organic fertilizer. Bulk buy and supply only to fertilizer ready farms. | |

Pesticides (Fungicides, Insecticides): Fake and sub-standard pesticides with bad and wrong labels and dosages are not what is recommended by COCOBOD. Pollution of river bodies and soil by pesticide residues. | COCOBOD should as a matter of urgency work with the Plant Protection and Regulatory Services Directorate (PPRSD) of MoFA, Ghana Environmental Protection Agency (GEPA), Agrochemical companies to ban, confiscate fake pesticides and arrest offenders. All pesticides must be labelled in English for farmers and service sprayers to comprehend. | |

| Tools and Equipment: General lack of appropriate and recommended pruners, slashers, harvesting poles, spraying machines. | Bulk procurement by COCOBOD and private companies for farmers at discounts for future payment using beans sold. | |

| Enabling Environment | Illicit cross-boarder trade (Smuggling of Cocoa Beans) (up to 80,000 Mt): Each year, there are significant, and mostly unrecorded, flows of cocoa traded across Ghana’s borders. The vast majority of this trade moves across the roughly 370-mile, largely porous border between Ghana and Côte d’Ivoire. | Enforce the Living Income Differential (LID) pricing mechanism. (Imposing a fixed “living income differential” of $400 a tonne on all cocoa contracts sold by Ghana and Cote d'Ivoire for the 2020/21 season. Step up intelligence gathering efforts and analysis. Anti-Smuggling Initiative |

| Finance | Capital: Access to finance is a challenge coupled with the risk of theft and loss of money. The default rate among farmers due to low productivity and bad weather is a risk. | The financial sector needs to train credit officers to understand the cocoa sub-sector. Introduction of digital payments and insurance. |

Production

| (Land Preparation, Planting, Shade Management, Pruning, application of pesticides and fertilizers, Weeding) Incidence of pests and diseases including capsid, stem borers, plant pests (mistletoe, epiphytes), canker, black pod, CSSV is a big challenge. Weeds are a big competitor when cocoa is young. Very low yields due to non-application of good agricultural practices(GAPs). | Application of pesticides at the correct time and in the right dosage. Adoption of critical and relevant GAPs. Investments in the maintenance of cocoa farm especially pruning. COCOBOD should continue the mass spraying, artificial pollination. The provision of pruners and slashers including training should continue. |

| Climate-related and other environmental risks including illegal mining and logging. A long spell of drought and bush fires are perennial problems faced by farmers and the sector. | Invest in irrigation even if it is low tech to provide adequate water. The government should enforce the policy on illegal mining (galamsey) and logging that destroys cocoa farms. | |

| Black pod Disease: This pathogen if left untreated can destroy all yields; annually the pathogen can cause a yield loss of up to 1/3 and up to 10% of total trees can be lost completely. | Improved agronomic practices (e.g. tree height reduction, opening of canopy, better pruning) More efficient spraying techniques Early warning system for early identification, detection, and communication of impending pest/disease outbreak | |

| CSSVD (cocoa swollen shoot virus disease): Mass destruction to many cocoa-growing areas like the Western North Region, where a larger portion of over 60% of Ghana's cocoa was produced. | Promote better agronomic practices Improve the transparency, efficiency, and timeliness of tree cutting and exgratiapayments. | |

| Post-harvest handling | Over or under fermenting and not drying cocoa at the required recommended days. | Ensure training is widespread and build incentives for good quality flavour. |

| Marketing | Internal: bean quality issues due to high moisture content, presence of foreign material and contaminants, theft of beans, accidents in transit, robbery of cash, the adjustment in weighing scales. These impact on farmers with respect to loss of beans, not getting value for beans sold, cost to COCOBOD/Quality Control Company especially and quality of beans sold in the export market and for processing. Depreciation of the cedi impacts on the purchasing power parity and earnings of farmers. External: High risks due to fluctuations and World Cocoa price that impact on producer price of cocoa in Ghana. | Improve post-harvest training and monitoring of farmers and on quality of beans. Invest in digital financing systems and introduce common weighing scales to all LBCs. Living Income Differential (LID) of $400 per MT will support farmers to improve their living standards. Government of Ghana through the Bank of Ghana must ensure that the cedi is stable in the long-term. |

| Processing | Percent beans processed locally (throughput) has increased but mostly for semi-processed products. Poor bean quality, lack of skilled labour, ready market for chocolates is a challenge due to the cost of bars. | Attract more investments in ready to eat and finished products as QCC supports farmers to improve the quality of beans. |

| Consumption | Low internal consumption of cocoa products in Ghana and Africa, Lack of aggressive promotion of the consumption of chocolates and other products. | Hold promotion campaigns and work to reduce the price of a bar or cocoa-based products so more people can buy. |

| Other | Lack of resources to support research along the production and processing stages. Weak extension support (high ratio of farmers to extension officer. | Provide adequate resources to the Cocoa Research Institute of Ghana and push private companies to invest a percentage of their money in research in Ghana. COCOBOD and Companies must work together in a PPP to improve extension delivery that is pivoted on the use of technological innovations. |

___

Pests & Diseases that Affect Cocoa

Impact of Major Pests and Diseases and their Control Measures

| Pest/ Disease | Symptoms | Control/Management |

|---|---|---|

Cocoa Swollen Shoot Virus Disease (CSSVD)  | Reddening of primary veins or ‘banding’ in young leaves • Yellow banding along the main veins of leaves • Vein clearing in leaves, sometimes producing a ‘fernlike’ pattern • Chlorosis or flecking and mottling of mature leaves • Stem and root swellings (some mild strains of the virus do not cause swellings in infected plants) • Abnormally shaped pods, usually smaller and spherical. | Target the virus or the vector. Control depends on the size of infections. If the number of visibly infected trees (VIS) is up to ten, all the trees within a radius of 5 meters from the VIS are cut. If the number is between 11 to 100 trees within a radius of 10 metres are cut, and where the trees are over 100 VIS within 15m radius are removed. If infections are detected early, spot treatment of removing the infected trees and their contacts are carried out before the disease can spread to other trees. Apply aboricides to cut surface. Use of barrier of immune crops around the replanted fields. Citrus and Oil palm are desirable barrier crops. |

Black pod caused by Phytophthora Palmivoraand Megakarya Spp  | Black pod disease starts when the infected pod shows some little yellow spots, which eventually turn brown and enlarge to a dark brown or black lesion within five days | Reduce shade and leave 6-9 trees per acre (15-20 trees per hectare) to increase aeration and reduces canopy humidity, thus reducing sporulation and spread of the disease. Regular weeding 2-4 times in a year. Prune and remove chupons: Removal of infected pods during and in between harvests Chemical control is achieved by spraying with recommended fungicides. The protectant fungicides, when sprayed onto the pods, form a chemical barrier on the surface of the pod and guard against infection whereas the curative fungicides are able to penetrate into the pod and arrest the growth of the fungus within it. Fungicides must also be applied at the recommended rates for safe and effective disease control. |

Mirids/Capsids  Mirids cause damage to seedlings, cherelles and shoots by sucking the sap from their symptoms. | Feeding puncture marks appear as water-soaked patches that turn black after 2-3 days. | Apply miricides: • Actara 240 SC (Thiamethoxam) at a rate of 17ml/11 litres or 85ml/ha • Confidor OD (imidacloprid) at a rate of 30ml/11 litres or 150ml/ha • Akate Master (Bifenthrin) at a rate of 100ml/11 litres or 500 ml/ha |

Mealy Pod (Pod Rot)  Caused by Trachyphaaera fructigena. Enters wounds on cherelles and pods. Farm sanitary harvest should be regular. | Caused by Trachyphaaera fructigena. Enters wounds on cherelles and pods. Farm sanitary harvest should be regular. Apply copper based fungicides such as Kocide 2000, Funguran-OH at rate 100g/15L or Nordox Super 75 WG at 75g/15L | |

Sting Bug  Sting bug (Atee) Bathycoelia Thallasina Both adult and nymph feed on the pod only. They suck the content of the beans. If the pod is young, it stops growing as soon as several beans have been damaged. | Pods attacked by stink bugs turn yellow, then brown and finally black. | Apply:

|

Stem borer  Cocoa stem borer (Eulophonotus myrmeleon) Damage to the stem is as a result of the larva feeding inside the stem producing an excreted material looking like saw-dust(frass) at the base of cocoa stem and/ or gummy exudates from entry and exit holes made by the larva (caterpillar) in the stem. | They bore holes in the stem and chew their way upwards. When they have caused enough harm, the leaves turn yellow and drop. The shoots die and the insects move to other trees. | Exit holes can be sealed with wooden plugs or cotton wool impregnated with COCOBOD approved insecticides.

|

___

Market Information

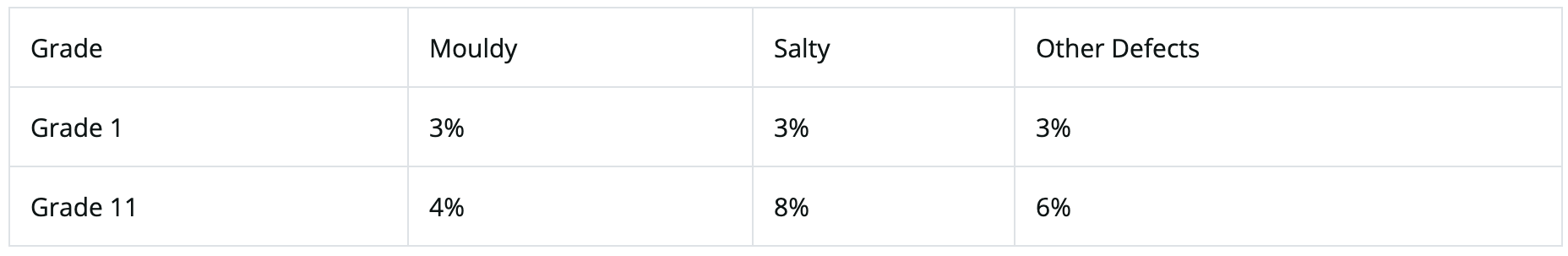

Ghana Cocoa Specification

Ghana remains the producer of the best quality bulk cocoa whiles the CMC maintains its reputation as the most reliable supplier of premium quality cocoa from origin. The minimum quality standards set by Ghana Cocoa Board exceed the benchmarks set in the international cocoa market for the trade in Good Fermented Cocoa.

Ghana cocoa beans have established a reputation as the ingredient of preference for quality-oriented chocolate manufacturers. That is why top brand chocolates and confectionery products are labeled with Ghana Cocoa for the high-end market positioning and a symbol of quality. Only the best associate itself with Ghana Cocoa. The superior quality specifications for Ghana Cocoa are attributed to the excellent post harvest handling by the Ghanaian farmer

Table 1: Cocoa Specification

Cocoa Production

Figure 1:Cocoa Production from 2001/2 to 2018/19

Cocoa Market Structure in Ghana

The internal marketing of cocoa beans was liberalized in the 1990s as part of the country’s structural reforms with the World Bank. This enabled the licensing of private sector operators to purchase beans from farmers on behalf of COCOBOD. However, the external marketing and sale of cocoa to local processors is the sole responsibility of Cocoa Marketing Company Ltd. (CMC), a wholly-owned subsidiary of COCOBOD.

Licensed Buying Companies (LBCs): COCOBOD has registered businesses with the responsibility to purchase cocoa at the farm gate at the ‘fixed producer price’ and transport it to the takeover points of Cocoa Marketing Company Ltd. (CMC). LBCs are responsible for delivering only cocoa that meets CMC’s stringent quality standards. Strict rules govern their buying activities. The government of Ghana has been pre-financing cocoa purchases with annual syndicated loans usually disbursed through the Bank of Ghana to LBCs to finance their purchases. There are currently 56 registered LBCs to undertake internal marketing of cocoa beans but less than 40 are active.

The LBCs, in active collaboration with haulers (private transport service companies), transport certified and sealed cocoa beans from the LBCs warehouses, located at the district level, to one of the three primary CMC intake warehouses (i.e. Tema port, Takoradi port, and the inland port at Kaase in Kumasi)

Quality Control System in Internal Cocoa Marketing: Quality Control Company (QCC) of COCOBOD is responsible for maintaining quality standards and enforcing quality control measures at all stages of the supply chain. This is to ensure Ghana delivers premium cocoa to the market. QCC operate in all the 74 cocoa districts in the 7 cocoa regions, and also in the 3 CMC intake warehouses. In its operations, the staff of QCC interface with farmers, LBCs, and transporters. QCC operate a 3 tier quality control systems:

- Stage 1: Is at the LBC district warehouse/depot where 100% of the cocoa bags in stock are sampled to check the beans against the quality attributes such as moisture level, bean size and colour, debris, moldy beans and adulterated cocoa. When the beans pass the quality test, the bags are sealed by the quality control staff (grader) and a purity certificate is provided which include grader identity and date bag was sealed.

- Stage 2: The cocoa from the LBC’s warehouse is transported to one of CMC’s intake warehouses. On arrival, quality parameters stated on the accompanying purity certificate are evaluated against the results of the second level of the quality test at the intake warehouse. The results of quality tests performed at this level must be consistent with the quality checks at the district warehouse.

- Stage 3: QCC prior to export also undertake another quality check at the CMC intake warehouses on the cocoa consignment to determine whether a particular consignment meets local and international quality standards.

Before the start of the cocoa purchasing season, QCC undertakes inspection and fumigation of storage sheds, warehouses and shipping vessels and all cocoa consignments before shipment.

Figure 2:The Flow of Beans from Producers to Cocoa Marketing Company (CMC)

Figure 2:The Flow of Beans from Producers to Cocoa Marketing Company (CMC)

There are many bottlenecks in the internal marketing of cocoa including;

- Malpractices by purchasing clerks at the LBC level including the use of faulty and adjusted scales,

- Some LBCs have low volumes of purchase and others are redundant and moribund,

- Some LBCs shun remote places which are considered difficult to reach or areas where cocoa output is low.

- There are also challenges with payment systems – Akuafo check and Cash which impact negatively on farmers as payments sometimes delay and monies are stolen.

These results in loss of beans and farmers are not paid for what they produce to sell. COCOBOD plans to instill sanity in the system through better monitoring and enforcement of weighing by promoting the use of digital/electronic scales and instituting a digital payment system.

Cocoa Pricing and Trends

Farm Gate Price (Producer Price)

Pricing of cocoa is done by a committee known as the Producer Price Review Committee (PPRC), which meets to review the cocoa prices payable to the farmers. This committee comprises the Government, COCOBOD, LBC’s and farmer’s representatives. The producer price is the price at which the country’s cocoa sector regulator – Ghana Cocoa Board (COCOBOD) – buys the produce of cocoa farmers at the farmgate.

To ensure farmers are not exposed to the direct impact of cocoa price volatility in the international market, the government of Ghana has intervened through Ghana COCOBOD by offering a minimum guaranteed price for the entire cocoa marketing season (October-September). The producer price or farm gate price is usually announced in October before the beginning of the season.

The producer price is based on the price COCOBOD expects to receive from the world market, having already sold between 70 - 80 percent of the crop forward. To this price, COCOBOD deducts the export tax and all the costs of its operations to arrive at what it calls “gross free on board (FOB) price.” Deductions are made from the gross FOB to pay for intermediate program costs across the supply chain such as jute sacks, agro-inputs, transportation etc. and the balance is the net FOB. Over the years the government aims to pay farmers at a minimum 70% of the net FOB price. The producer price and charges for other services are determined at the beginning of the season by the Producer Price Review Committee (PPRC) made of up of stakeholders in the cocoa sector.

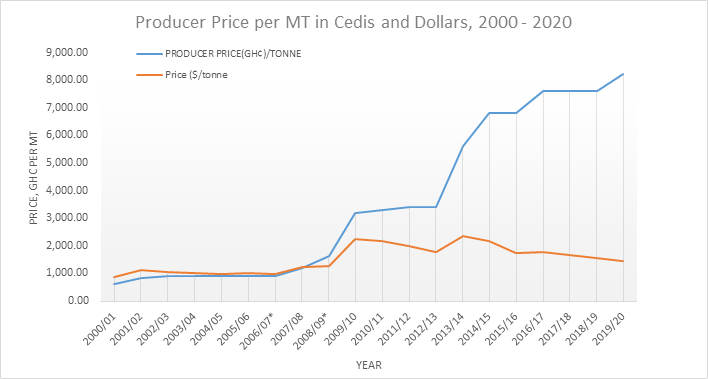

Between 2001/2002 and 2022/2023, the annual producer price of cocoa has increased in local currency terms from GH¢ 53 per bag (GH¢ 850/MT) to GH¢ 800 per bag (GH¢ 12,800/MT). Between 2021 /2022 and 2022/2023 government increased the producer price of cocoa by 21% from GH¢10,560 per tonne to GH¢12,800.00 per tonne translating into GH¢660 and GH¢800 per bag of 64kg respectively over the period. The producer price for cocoa remained at GH¢7,600 for over 3 years between 2016 to 2018 before it was increased to GH¢8,240 in the 2019/2020 season.

For the current cocoa season 2023/2024, the producer price to farmers increased by more than 63% from GH¢12,800 in previous season to GH¢20,943 ($1,837) per tonne for the 2023/2024 season.

In dollar terms, the price has increased from $ 1,465 per MT 2019/20 to $1,837 per MT in 2023/2024.

Cocoa Producer Price in Ghana Cedis and Dollars

Figure 3: Cocoa Producer Price

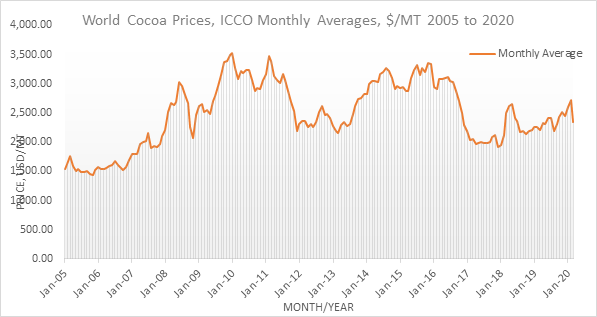

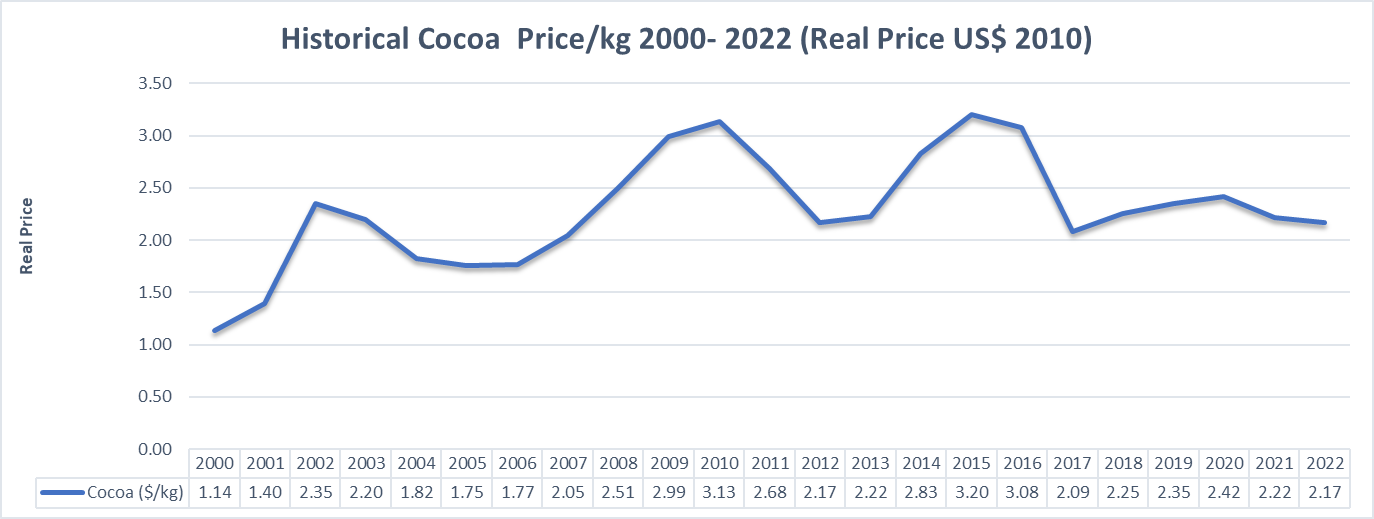

According to the International Cocoa Organization (ICCO), the world market price of cocoa has decreased from an average of $ 3,134 per tonne in 2015 to 2,340 USD per MT in 2020. In January 2018, the price reduced to about $ 1,951 necessitating the setting up of Living Income Differential (LID) in collaboration with Cote d’Ivoire and agreement from Cocoa Sustainability Companies.

World Market Cocoa Monthly Prices, 2005 to 2020

Figure 4: World Cocoa Market

Over the past few months, the price rallied to $ 2,600 in January 2020 only for it to drop by about $ 300 after the novel coronavirus started infecting people in Europe and US.

Major shipping destinations for Ghana’s cocoa is the European Union – Belgium, Switzerland, Netherlands and in Asia – Japan and recently China.

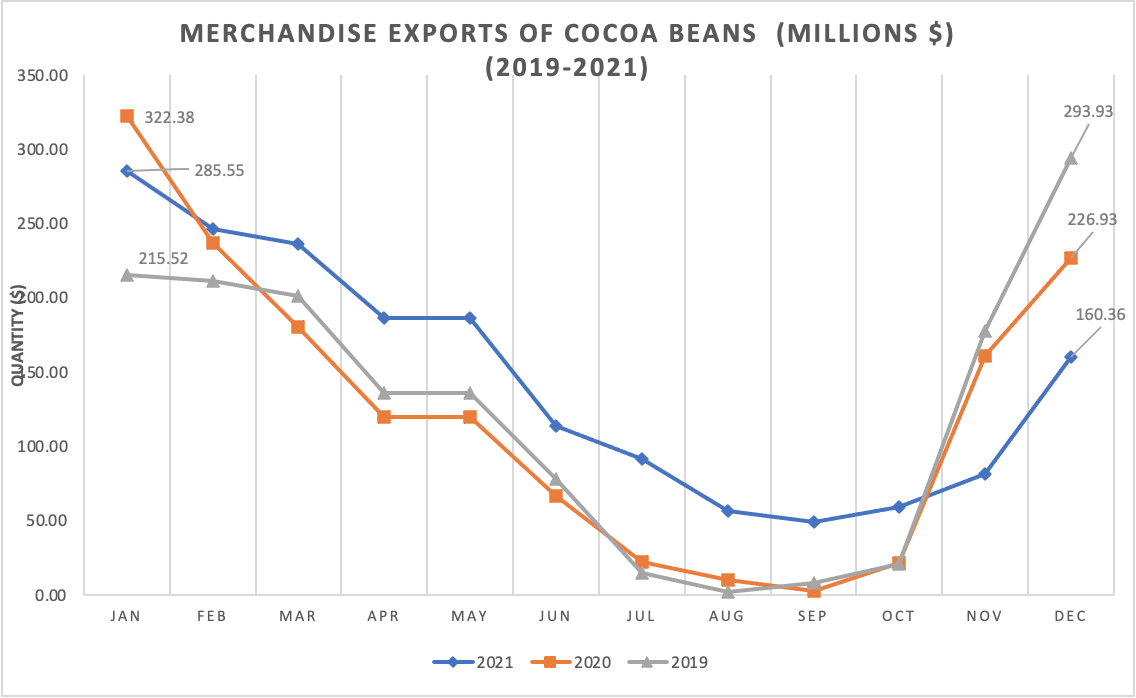

COCOA BEANS EXPORT

In value terms, shipment abroad of cocoa beans declined from $ 293.93 million in 2019 to $ 160.36 million in 2021. in general, exports, however, continue to indicate a relatively perceptible setback. the growth pace was the most rapid in 2019 when export peaked at $ 293.93 million.

Figure 5: Exports of Cocoa Beans

An overall positive trend was observed in the prices of the December 2021 and March 2022 cocoa futures contracts during December 2021. This trend was fuelled by the optimism on demand for cocoa products, in at least the mid-term, and the low year-on-year arrivals recorded in main cocoa producing countries in Africa. The annual average of the US-denominated ICCO daily price stood at US$2,427 per tonne, up by 3% compared to level reached the previous year. Ghana is the world's second largest producer of cocoa, with cocoa farmers earning Ghc660 a bag of 64 kilos, or $111.86 (2021). Thus, Ghana paid its cocoa farmers $25 (approximately Ghc147.50) more than neighbouring Ivory Coast.

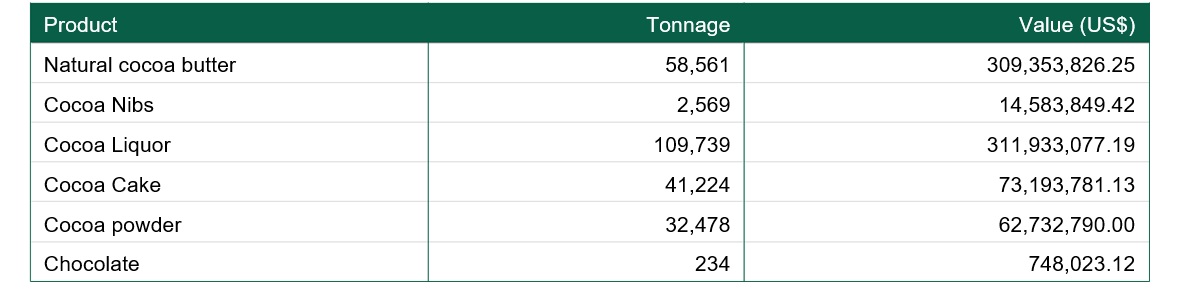

COCOA PRODUCTS EXPORT

A total of 302,641 tonnes of cocoa beans were processed by ten (10) local processing companies into semi-finished and finished products. The companies include;

- Barry Callebaut Limited

- Cocoa Processing Company Limited (CPC)

- Niche Cocoa Industries Limited

- Cargill (Ghana) Limited

- WAMCO

- Olam Ghana Limited

- BD Associates

- Cocoa Touton Ghana Limited

- Plot Enterprise

- Afrotropics Limited

Exports of cocoa products by the ten (10) cocoa processing companies during the 2019/20 crop year comprised:

Quality Issues, Traceability, Certification and Standards

- One of the six areas identified by COCOBOD for the improvement of the sector is the coordination of programs and projects in the Cocoa Sector especially in setting Ghana standards for traceability and certification, inter-ministerial cooperation towards improved land/forest management, payments for environmental services.

- Farmer education on appropriate practices such as fermentation, drying of beans, use of weedicides that has a direct relationship with quality of beans should be stepped up.

- Quality Control Company (QCC) oversees and check the quality of cocoa beans – size, flavour, purity or wholesomeness, consistency/uniformity, yield of dry nib and functional potential.

- Increased attention to cocoa bean quality, traceability and certification was a key element in the scenario planning.

- Rain Forest Alliance/UTZ, Fairtrade, CEN/ISO requirements should be followed before premiums are paid to farmers (For more on cocoa certification and challenges, please reference Cocoa Barometer). Farmers are paid premiums by these certification bodies when they are able to meet the critical control points and certification standards on their farms.

- COCOBOD encourages the certification of organic cocoa as required by the market.

___

Enterprise Budget for Cocoa

___

Key Policies and Projects in the Cocoa Sector

- Ghana Cocoa Board is the statutory public institution that regulates and monitors the operations of Ghana’s cocoa industry. The functions of COCOBOD centre on the production, research, extension, quality control and internal and external marketing of cocoa.

- Government cocoa intervention policies and regulation is implemented by the Ghana Cocoa Board through the Cocoa Sector Development Strategy. The second Cocoa Sector Development Strategy (CSDS II) seeks to emphasize productivity enhancement through the empowerment of smallholder cocoa farmers to adopt modern technologies. It is also aimed at positioning the cocoa industry strategically to operate efficiently and effectively in a sustainable manner within a modern business environment.

- Current policies captured in the strategy are geared towards improving cocoa productivity (the output per unit area) from the approximately 450kg/ha to 1,000kg/ha by 2027. Increased productivity will improve and sustain incomes above current levels in the midst of low cocoa production, quality and increased export revenues.

- Some of the major policies in the pre-harvest area include productivity enhancement programs (PEPs) such as efficient extension service delivery through a public-private partnership including Farmer Business School (FBS), free distribution of cocoa seedlings, pollination of cocoa trees, pilot irrigation, distribution of slashers and pruners.

- Other policies which have continued since 2001 are the National Cocoa Disease and Pest Control (CODAPEC) programme, popularly known as “mass spraying” where farmers are supplied with free inputs for spraying against mirids and black pod disease and trained spraying gangs are deployed to spray cocoa farms. The Cocoa Hi-Tech programme was introduced in 2003 to demonstrate to farmers the importance of fertilizer application to boost cocoa production. Government input policy is to support farmers to procure pesticides and cocoa fertilizers at subsidized prices by involving private manufacturing and distribution firms.

- It is estimated that about 40% of the cocoa tree stock in Ghana is unproductive. This includes over-aged and CSSVD infected farms. The present government’s policy is to cut infected farms, treat them, pay compensation and support farmers with food crop planting material such as plantain which serves as temporary shade and food for the family. Over the next ten years, COCOBOD plans to undertake the rehabilitation of old/moribund farms by removing 162 million trees covering 147,000 ha by 2021/22 and additional 162 million trees covering 147,000 ha by 2026/27 crop years. Farmers are supported with cocoa seedling to re-plant and rehabilitate and rejuvenate the farms.

- Another policy is the Youth in Cocoa Farming where COCOBOD provides technical support and inputs, build capacity to access funds and encourage the youth to establish and own cocoa farms by securing their own farmlands.

- Ghana continues to develop Climate-smart cocoa systems to sustain cocoa production under a changing climate and ensure that the forest is not degraded.

- The government of Ghana is seeking to achieve an income balance between the farmer and the other stakeholders in the industry to ensure profitability among all stakeholders will be established in addition to a stabilization fund.

- The private sector mainly World Cocoa Foundation companies have many cocoa sustainability programs in Ghana. Other NGOs such as Solidaridad, AgroEco and certification bodies have a number of on-going field programs.

___

Cocoa Growing Seasons and Cropping Cycle

Soil Suitability Map for Cocoa

Processing

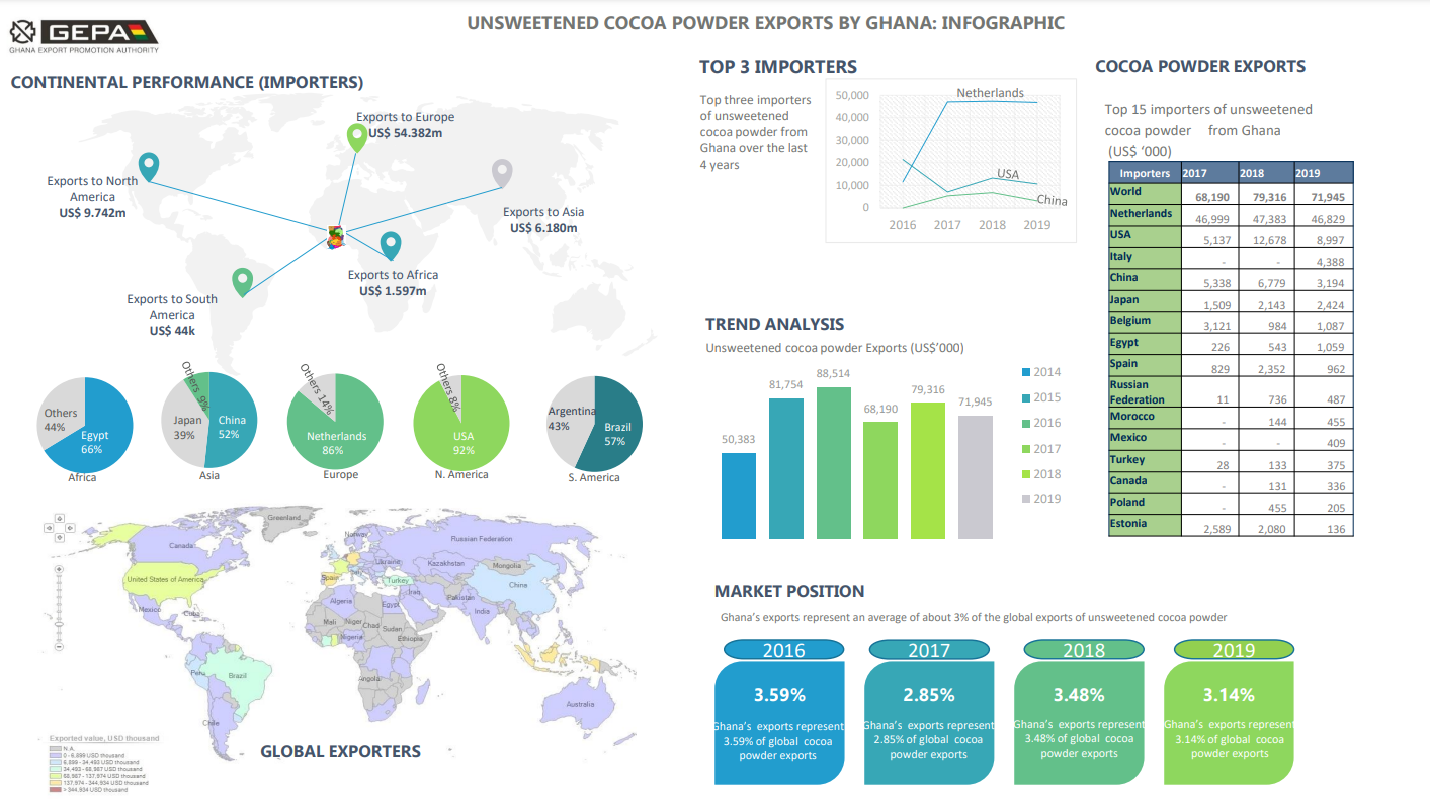

Government Strategy on Value Addition through Processing

- Government strategy in processing cocoa is targeted at increasing domestic processing of cocoa beans to 50% of the annual output, from 30% in 2017/18. This will be achieved primarily by increasing the capacity utilization of existing facilities and encouraging the establishment of new processing units. In order to increase the value of processed cocoa to Ghana, COCOBOD is encouraging processing companies to move towards secondary and tertiary processing.

- Value addition to cocoa starts by undertaking practices that improve post-harvest handling – fermentation, drying, bagging etc.

- COCOBOD mostly sell light crop beans (minor season) for domestic processing at a discount. However, most local processors also buys main crop cocoa to supplement the minor crop beans for processing.

In Ghana, currently, there are 13 cocoa processing companies with a combined installed capacity of 499,100 tonnes. Of the 13 registered processors, 46.1% are wholly Ghanaian owned, 15.4% are joint ventures between foreign and Ghanaian companies and 46.1% are wholly foreign-owned.

Out of the top four processing factories in terms of processing capacity and production, three are foreign-owned: Barry Callebaut, Cargill and Olam, which controls 34.5% of the installed operational capacity, with the public-owned Cocoa Processing Company (CPC) controlling another 13% of the capacity. Only two of these companies (Niche & CPC) produce up to the tertiary level. Most of the processing factories are producing below capacity due to an insufficient supply of beans, and high overall manufacturing costs, among other factors.

- The major processing companies in Ghana are Cocoa Processing Company, Cargill, Barry Callebaut, Olam Processing, and Touton. Smaller processing companies include PLOT, Niche, Afrotropic, etc.

- The products include cocoa powder, butter, liquor, and cake. Most of the major crop beans are exported to processing companies and brands abroad. CPC and a few others produce chocolate bars, pebbles, cocoa powder etc. Nestle, for instance, produces beverages and other confectioneries in the Ghanaian market.

Table 2: Major Cocoa Processing Companies in Ghana and Installed Capacity

| No. | Company | Ownership Profile | Date of Establishment | Installed Capacity | Number of Employees | Processed Products | |

|---|---|---|---|---|---|---|---|

| 1 | Barry Callebut Ltd-Tema | Wholly foreign-owned (Swiss) | 2000 | 65,000 | 100 | Cocoa liquor, butter, powder | |

| 2 | Cargill - Tema | Wholly foreign-owned (Belgian, France) | 2008 | 65,000 | 173 | Cocoa liquor, butter, powder | |

| 3 | CPC Ltd- Tema | Ghanaian (Public) | 1965 | 64,500 | 269 (plus 131 casuals) | Cocoa paste, butter, powder, chocolate | |

| 4 | Olam (ADM)- Kumasi | Wholly foreign-owned (Singapore) | 2008 | 42,000 | 90 (120 casuals) | Cocoa liquor | |

| 5 | PLOT Enterprises - Takoradi | Wholly Ghanaian owned | 2009 | 32,000 | 100 | ||

| 6 | BD and Associates _Tema | Wholly foreign-owned | 27,000 | ||||

| 7 | Niche Cocoa Industry -Tema | Wholly Ghanaian owned | 2007 | 18,000 | 150 | Cocoa paste, butter, powder, chocolate | |

| 8 | Touton S.A - Tema | Wholly foreign-owned (French) | 2016 | 15,300 | |||

| 9 | Afrotropic Cocoa Processing Ltd - Accra | Joint Venture (Ghana, Italy) | 2007 | 12,500 | 110 | ||

| 10 | WAMCO Ltd-Takoradi | A joint venture (Ghana, Germany) | 1947 | 80,000 | |||

| 11 | Real Products Ltd - Takoradi | Wholly Ghanaian owned | 50,000 | ||||

| 12 | Commodities Processing Industries Ltd. | Wholly foreign-owned | 15,300 | ||||

| 13 | Chocomac Limited | Wholly Ghanaian owned | 2008 | 12,500 | Cocoa liquor/mass, Coco butter, Cocoa cake and Cocoa powder |

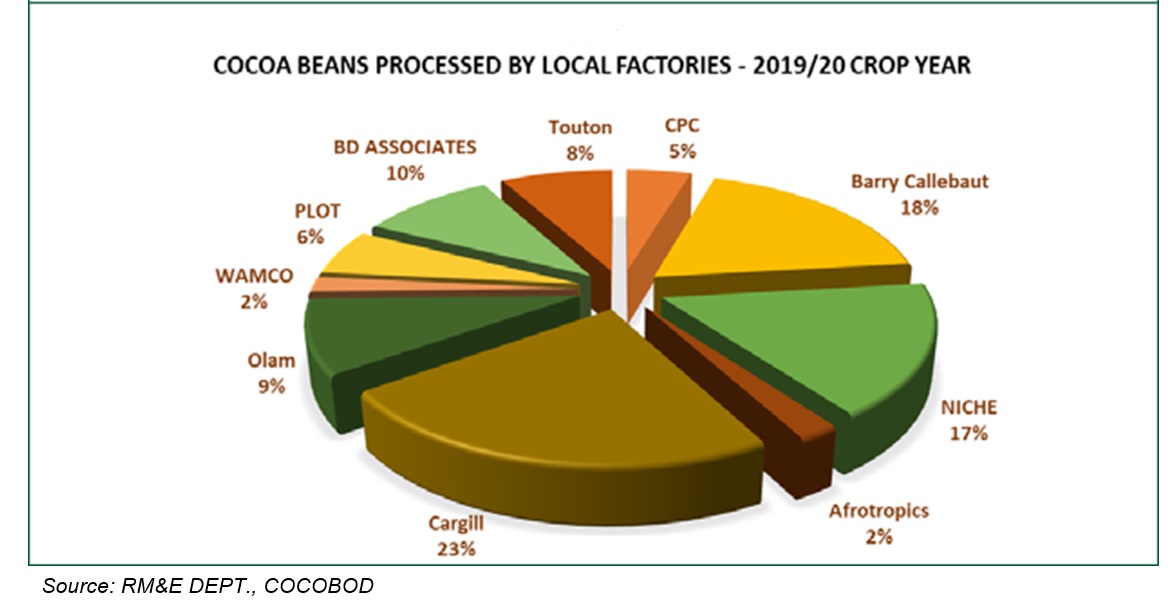

Cocoa Beans Processed and Products Export

(i) Beans Processed

In 2019/2020 a total of 302,641 tonnes of cocoa beans were processed by ten (10) local processing companies into semi-finished and finished products. The companies include; 1. Barry Callebaut Limited 6. Olam Ghana Limited 2. Cocoa Processing Company Limited (CPC) 7. BD Associates 3. Niche Cocoa Industries Limited 8. Cocoa Touton Ghana Limited 4. Cargill (Ghana) Limited 9. Plot Enterprise 5. WAMCO 10. Afrotropics Limited Cargill (Ghana) Limited, Olam Ghana Limited and Barry Callebaut Limited are members of multinational groups with operations worldwide.

Figure 3 depicts the shares of cocoa beans processed by the respective local processing factories during the year. Cargill and Barry Callebaut Limited had market share of about 23% and 18% respectively, and accounting for 41% of domestic cocoa processing in 2019/20.

Figure 1: Cocoa Beans Processed by Local Factories

Resources on Cocoa

Links to resources

COCOA BOARD ANNUAL REPORTS AND CONSOLIDATED FINANCIAL STATEMENTS https://cocobod.gh/resource_files/51st-annual-report-and-financial-statements-2019-2020.pdf

COCOA POWDER (SWEETENED)- POTENTIAL MARKET REPORT 2019 https://www.gepaghana.org/market-report/cocoa-powder-sweetened-potential-market-report-2019/

USA MARKET ACCESS REQUIREMENTS FOR COCOA https://www.gepaghana.org/access-requirement/usa-market-access-requirements-for-cocoa/

EUROPEAN MARKET ACCESS REQUIREMENTS FOR COCOA https://www.gepaghana.org/access-requirement/european-market-access-requirements-for-cocoa/

What requirements must cocoa beans comply with to be allowed on the European market? https://www.cbi.eu/market-information/cocoa/buyer-requirements

Annual Cocoa Purchases by Destination https://cocobod.gh/annual-purchases

Regional Cocoa Purchases https://cocobod.gh/cocoa-purchases

Others

- Investing for Food and Jobs (IFJ): An Agenda for Transforming Ghana’s Agriculture (2018-2021), pages 61-64. 2017. MoFA.

- Ghana Cocoa Sector Development Strategy (CSDS II), 2017/18 – 2026/27. The draft report, Ghana Cocoa Board.

- Manual for Cocoa Extension in Ghana, Ghana Cocoa Board, 2016.

- Cocoa Barometer, Antoinne Fountain, Voice Network, 2018.

Comments

Post a Comment