Cassava Summary Fact Sheet

Production

20,954,000 MT

Source: SRID, 2020

1,061,000 Ha

Source: SRID,2020

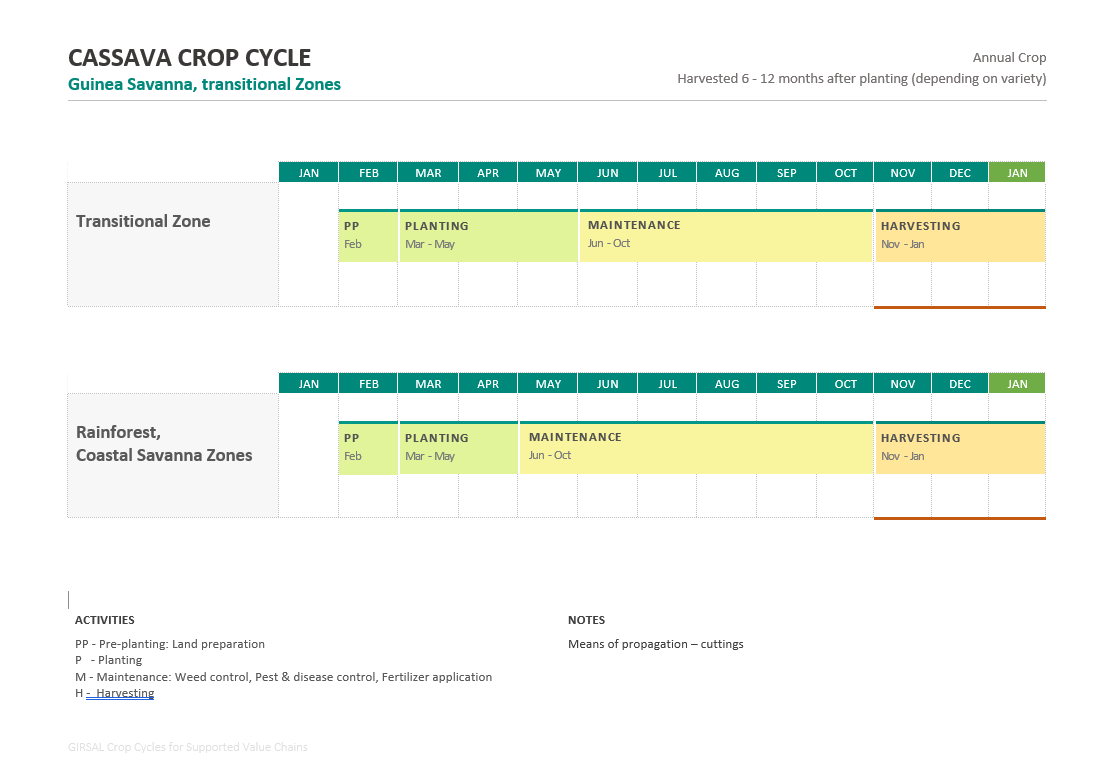

Guinea Savanna Zone (May - June)

Transitional, Forest and Coastal Savanna Zones (April-May)

1m x 1m

1m x 0.9m

1m x 0.8m

0.9m x 0.9m

The new planting distance recommended by research is the 1m x 0.8m and 0.9m x 0.9m. Research shows that these new recommendations help in the control of weeds.

100cm x 100cm (10,000)

100cm x 90cm (11,111)

100cm x 80cm (12,500)

90cm x 90cm (12,345)

NPK 12-30-17+0.4Zn; NPK 15-15-15; NPK 17-10-10; Muriate of Potash and Urea

6 bags per hectare (apply as split; 4 weeks after planting and 16 weeks after planting – all spot placement) OR

Apply 3-4 bags of NPK per hectare 4 weeks after planting and 1.5 bags of urea and 1 bag of Muriate of potash mixed as second application at 16 weeks after planting – spot placement and covered.

Organic fertilizer - Cow dung, Poultry manure and Compost : Broadcast and work into the soil before planting.

6 bags of NPK per hectare or 25-30g of fertilizer per plant (apply as split; 4 weeks after planting and 16 weeks after planting – all spot placement)

OR

Apply 3-4 bags of NPK per hectare 4 weeks after planting and 1.5 bags of urea and 1 bag of Muriate of potash mixed as second application at 16 weeks after planting – spot placement and covered.

Organic

- Cow dung – 3 tons/ha.

- Poultry manure – 4 tons per ha.

- Compost – 5 tons per ha.

NPK 17-10-10 for Forest-Savannah Transition

NPK 15-15-15 (all ecologies)

NPK 12-30-17+0.4Zn (all ecologies)

___

Overview

General Overview of Cassava Production

Cassava is the most widely cultivated crop in Ghana, with 90% of all rural households involved in its production. It is comparatively the most produced agricultural crop by quantity as well as the most processed root and tuber crop with commercial production basis in all regions of Ghana except the Upper East and Upper West Regions (SRID, 2020).

Ghana is the number three producer of cassava in Africa after Nigeria and Democratic Republic of Congo and the fifth largest in the world (FAO. 2019, Tridge, 2020). In 2020, cassava cultivation totalled 24,368 million metric tons which accounts for 22% of Ghana's Agricultural Gross Domestic Product (MOFA-SRID, 2020). The production output is also approximately 7.47 per cent of global output which is approximately 303.57 million metric tonnes (Tridge, 2020). The potential demand for raw cassava root is estimated at 27,488,504 MT. This production figure is likely to increase by the close of 2021, due to its importance in the National Economy and the expansion in old and establishment of new processing facilities in the country.

Currently, there are 31 high yielding improved varieties developed by the research institutes and universities mainly CSIR-Crops Research Institute, CSIR-Savanna Agricultural Research Institute, Biotechnology and Nuclear Agriculture Research Institute (BNARI) of the Ghana Atomic Energy Commission, University of Cape Coast and Kwame Nkrumah University of Science and Technology with different uses including, fufu, agbelima, gari, starch, ethanol and high-quality cassava flour (HQCF) as industrial raw material. However, these are insufficient to meet the different needs and the growing demand for improved varieties to satisfy the emerging markets. Hence the need to develop, intensify multiplication activities and disseminate more superior varieties and to meet demands of specific markets.

Cassava Varieties

Variety | Maturity (Months) | Yield (MT/Ha) | Disease/Pest Tolerance | Dry Matter Content | Uses |

Afisiafi | 12-15 | 28-35 | Tolerant to Cassava Mosaic Disease (CMD), Cassava Anthracnose and Bacteria Blight | 32% | Starch, flour and gari |

Abasafitaa | 12-15 | 29-35 | Tolerant to Cassava Mosaic Disease (CMD) | 35% | Starch, flour and gari |

Tek-Bankye | 12-15 | 30-40 | Susceptible to Cassava Mosaic Disease (CMD) | 30% | Fufu, gari and ampesi |

Nyeri-Kogba | 8-12 | 17-29 | Tolerant to Cassava Mosaic Disease (CMD) | 33% | Tuozaafi, gari, starch and flour |

Eskamaye | 8-12 | 16-23 | Tolerant to Cassava Mosaic Disease (CMD) | 33% | Tuozaafi, gari, starch and flour |

Fil-Ndiakong | 8 | 16-19 | Tolerant to Cassava Mosaic Disease (CMD) | 36% | Tuozaafi, gari, starch and flour |

Nkabom | 12-15 | 28-32 | Tolerant to Cassava Mosaic Virus (CMV) | 32% | Starch and fufu |

IFAD | 12-15 | 30-35 | Tolerant to Cassava Mosaic Virus (CMV) | 30% | Starch and fufu |

CRI-Agbelifia | 12 | 50.8 | Tolerant to Cassava Mosaic Disease (CMD) | 25% | Starch and gari |

CRI-Essam Bankye |

12 | 49 | Tolerant to Cassava Mosaic Disease (CMD) | 20% | Flour |

CRI-Bankye Hemaa |

12 | 48 | Tolerant to Cassava Mosaic Disease (CMD) | 21% | Fufu and Bakery Products |

CRI-Doku Duade |

12 | 45 | Tolerant to Cassava Mosaic Disease (CMD) | 24% | Good for starch production |

Capevars Bankye | 8-12 | 20-64 | Resistant to Cassava Mosaic Virus (CMV) | 25% | Fufu, ampesi, gari, flour, agbelima and industrial starch |

Bankye Botan | 9-12 | 20-60 | Tolerant to Cassava Mosaic Disease (CMD) | 25% | Agbelima, flour, kokonte and industrial starch production. |

CRI-Ampong | 12 | 45 | Resistant to Cassava Mosaic Disease (CMD) | 36% | lour, starch and fufu |

CRI-Broni Bankye |

12 | 40 | Tolerant to Cassava Mosaic Virus (CMV) | 33% | Flour, starch and bakery products. |

CRI-Sika Bankye |

12 | 40 | Tolerant to Cassava Mosaic Virus (CMV) | 36% | Flour and starch production |

CRI-Otuhia |

12 | 35 | Tolerant to Cassava Mosaic Virus (CMV) | 39% | Flour and starch production |

CRI-Duade Kpakpa |

12 | 40-60 | Resistant to Cassava Mosaic Disease (CMD) | 37% | Fufu (poundable), flour, starch, industrial alcohol |

CRI-Amasaman bankye |

12 | 40-57 | Resistant to Cassava Mosaic Disease (CMD) | 38% | Flour and Bakery products |

CRI-AGRA Bankye |

12 | 35-60 | Resistant to Cassava Mosaic Disease (CMD) | 32% | Flour and starch production |

CRI-Dudzi |

12 | 35-50 | Resistant to Cassava Mosaic Disease (CMD) | 38% | Flour and starch production |

CRI-Abrabopa |

12 | 30-45 | Resistant to Cassava Mosaic Disease (CMD) | 40% | Hi-Starch |

CRI-Lamesese |

12 | 40-50 | Tolerant to Cassava Mosaic Disease (CMD) | 39% | Fufu (poundable), flour and beta-carotene |

CRI-Bediako |

12 | 36-40 | Resistant to Cassava Mosaic Disease (CMD) | 33% | Fufu, flour and starch |

Crops Research |

12 | 40-45 | Tolerant to Cassava Mosaic Disease (CMD) | 30% | Fufu, flour and starch |

Nyonku agbeli |

12 | 23 | Tolerant to Cassava Mosaic Disease (CMD) | 26.06% | Flour and gari production |

Kpornu agbeli |

12 | 24 | Resistant to Cassava Mosaic Disease (CMD) | 26.06% | Flour and gari production |

Tetteh bankye |

12 | 19 | Resistant to Cassava Mosaic Disease (CMD) | 21.20% | Fufu, gari and flour production |

Fufuohene bankye |

12 | 25 | Resistant to Cassava Mosaic Disease (CMD) | 41.90% | Fufu, starch, flour and gari production |

Ampesi Bankye |

12 | 22 | Resistant to Cassava Mosaic Disease (CMD) | 40% | Ampesi, fufu, starch and flour |

Source: NVRRC, 2020

Adoption of improved varieties by Ghanaian farmers has increased significantly over the past 10 years (from 19% to 36%) (RTIMP, 2010; Mywish et al., 2016), primarily due to its use as industrial starch, high quality cassava flour (HQCF), ethanol, gari and chips for local industries and international starch-based industries (eg, Guinness Ghana and Accra Brewery in the production of Ruut Extra Premium and Eagle Beer respectively). Higher adoption of improved varieties could be achieved if farmers understand market potential of various varieties and the suitable varieties are made available through demonstrations and sensitization of their differential uses to farmers and other stakeholders.

Some critical challenges in the sector include; limited availability and accessibility to clean and healthy planting material, pests and diseases, declining soil fertility, non-adoption of good production practices by farmers, drudgery in harvesting (poor harvesting technology), limited value addition, poor markets and cyclical gluts resulting in high post-harvest losses.

Again, over 60% of cassava produced is consumed locally in different forms whiles the rest is either processed as industrial raw material or allowed to go waste.

The importance of cassava as industrial crop is currently gaining prominence through the emerging markets. Ghana has the capacity to transform her cassava industry into a major economic enterprise, on account of the potential of cassava as an industrial raw material. However, several factors have contributed to prevent the cassava industry in Ghana from achieving the prominence it requires in changing livelihoods of many Ghanaians who depend on the crop either directly or indirectly as well as improving the economy of Ghana. A good example is the delay in the implementation of the HQCF inclusion policy which has been proposed since 2011. There have been several attempts to push this agenda forward but has not seen the light of day. This, when implemented will increase the scale of production and make the industry very attractive and competitive.

According to MOFA-SRID (2020), the area planted to Cassava nationwide was 1,061,000 Ha resulting in a production output of 24,368,000 MT. The average yield on-farm for the commodity is 22.97 MT/Ha but has a potential of up 60 MT/Ha. Studies have shown that, this productivity can be improved. Proper use of agro-chemicals and high yielding certified planting materials or improved varieties as well as employing mechanization and good agronomic practices can result in improved productivity.

Cassava is one of the priority crops earmarked for promotion in Ghana’s Investing for Food and Jobs (IFJ) Agenda. The IFJ details the roadmap for the implantation of the new FASDEP in the country. The IFJ was designed to address the challenges identified in the implementation of the first generation of the METASIP under the CAADP framework. The main thrust of the plan is to ensure government’s objective of modernizing the agri-food system to transform the economy of Ghana is attained.

In 2019, the Government of Ghana identified cassava as one of the priority crops in its Planting for Food and Jobs campaign to ensure food and nutrition security and increase farmers’ incomes while providing jobs for the unemployed. The commodity has also been identified as a major agro-processing commodity under the One District One Factory (1D1F) Programme. New cassava businesses have been approved under the 1D1F programme with the aim of strengthening the cassava sector value-chain. Some of these businesses include Amantin Agro-processing to produce starch, Sinostone Group and Caltech for the production of ethanol among others.

Food Balance Sheet (2020/2021) Production Season (Cassava)

| Total Production | 24,368,000 MT |

| Total supply (available for human consumption) | 22,964,205 MT |

| Total Imports | 0 Mt |

| Domestic Utilization (food) | 17,658,254 MT |

| Per capita consumption | 570kg/annum |

| Feed and Wastage | 6,889,261MT |

| Import dependency ratio | 0% |

While a huge economic potential exists in the cassava system, it also faces a myriad of challenges from production, through processing to marketing which prevents it from reaching its full potential. Some of these challenges include relatively low productivity as a result of poor agronomic practices, post-harvest losses, poor processing and storage practices as well as weak marketing practices and channels.

___

Cassava Value Chain

The cassava value chain in Ghana comprises a range of stakeholders, including aggregators, producers, processors, exporters and transporters, as well as input suppliers and other service providers.

The value-chain analysis focuses on the different stakeholders at each operational level in the cassava sector. It also focuses on quality, environment, social, sustainability, food safety and organic requirements, the cassava sector regulatory infrastructure and how value-chain stakeholders are complying with key industry standards.

Over 70 per cent of farmers in Ghana are involved in the cultivation of cassava roots, either for consumption or to sell (WACOMP, 2019). Cassava roots are usually transported from farms by truck, tricycles or hand-pushed trolleys to processing facilities, where they are turned into various products. The final products are either transported to local or international markets by the processors or purchased by aggregators, who grade, re-bag, weigh, label and store products before exporting them.

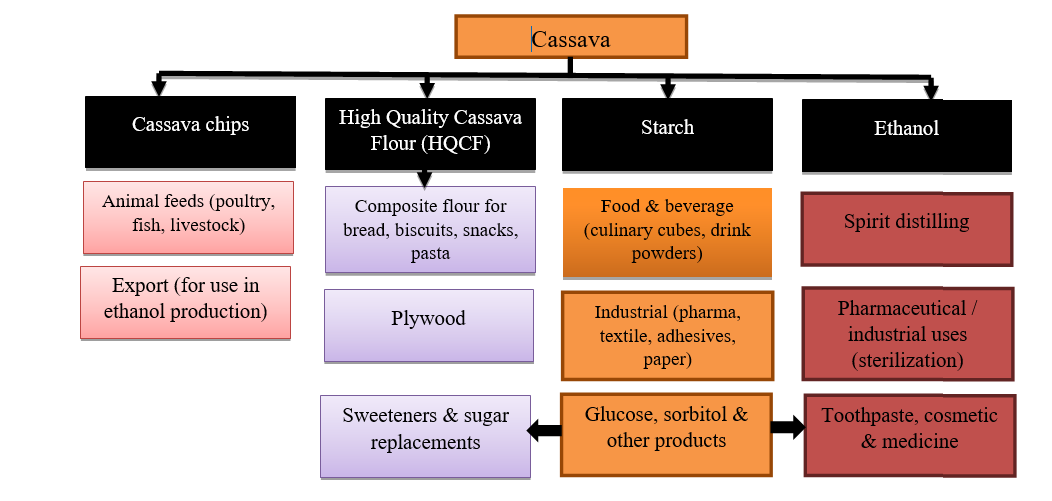

Gari, high quality cassava flour (HQCF), starch, ethanol and cassava chips are leading cassava export products. Several local delicacies, including fufu, banku, akyeke and konkonte, are also prepared from the crop or constitute a major ingredient. The production of biogas and biofuel from the by-product of cassava is an emerging market of the cassava industry.

The cassava value chain is supported by a number of service providers, such as agro-input and agronomic support institutions, which provide training, planting materials, agrochemicals and other forms of agronomic support. Other key stakeholders with vertical links to the chain include processing equipment manufacturers and value-chain finance companies. Inspection, verification, testing and certification institutions also provide key services.

Input Provision

The input acquisition or provision is the first stage in the value chain of the cassava commodity. It is heavily dependent on high-cost imported inputs except planting material -cassava stems. Sources of cassava stems are from neighbouring farms, trained cassava planting material multipliers, Agricultural Stations and the Council for Scientific and Industrial Research (CSIR).

At least thirty-one different improved varieties of cassava are produced in commercial quantities for diverse uses such as for fufu, starch, flour, ethanol, chips etc. The varieties include the following: Afisiafi, Abasafitaa, Tekbankye, Agbelifia, Sika Bankye, Bankye Hemaa, IFAD, Amansan Bankye, Nyonku Agbeli, Capevars Bankye, Crops Research, Doku Duade etc. These varieties are of high quality and are produced largely by small-scale farmers in the rural areas throughout the country mostly using organic production methods with minimal or without added inputs like fertilizers, herbicides, fungicides or insecticides.

The sector is well-organized but with a few numbers of infrastructural support such as pack houses, haulage and production inputs. There is also a strong scientific and research support for the crop, spearheaded by the Council for Scientific and Industrial Research (CSIR) and the Universities.

Most farmers prepare their land manually though a few that have access to tractors and animal traction do use them for land preparation. There are a number of input dealers or suppliers based at the district level and situated either within the scope or distant from the targeted producing communities. These input dealers are not responsible for transportation logistics for their clients and offer no after sales services. Some of these input dealers or suppliers do not always have experience in cassava production. Notable dealers or institutions with some knowledge in cassava production include Wienco Ghana Limited, Chemico Ghana Limited, Yara Ghana Limited, RMG Ghana Limited, Calli Ghana,

Producers can access certified planting materials from the CSIR-Crops Research Institute, Ghana Atomic Energy Commission, University of Cape Coast, Amenfi Farms, Fosua Food Chain and MOFA Agricultural Stations (eg. Wenchi, Asuansi, Mampong and Kpeve).

Production

This is the heart of the value chain. In Ghana, it is characterized by smallholder farmers making up most of the cassava production and account for production of more than 90% of cassava produced in the country. Most of these smallholders cultivate on 0.2-2 hectare farms with infrequent use of inputs like fertilizers and basic agronomic practices (MOFA-SRID, 2020). Large plantations are however emerging in the Bono East and Volta regions. Small producers provide labour for land preparation, planting, harvesting, and transportation to processors. Currently, about 80% of cassava farmers sell fresh cassava rather than dough, flour or gari to avoid marketing risks.

The average yields of many farmers are relatively low, with some estimates as low as 10-15 MT/ha. The national average however is about 22 MT/ha. The low yields can be attributed to extensive use of unimproved landraces, uncertified planting materials, pests and diseases attacks and poor agronomic practices adopted by farmers.

According to the Food and Agriculture Organization of the United Nations (FAO), cassava yields in Ghana increased from 8 MT per hectare to 15 MT per hectare between 1990 and 2010. The current average national figure of 22 MT per hectare is slightly higher than the global average of 12 MT per hectare. The estimated total land under cassava production in 2019 was 1,021,000 hectares. The optimum productivity of most of the improved cassava varieties is between 40 and 60 MT/ha but despite the fact that the area under cassava cultivation reached over one million hectares in the 2019 cropping year, the total national output was around 22.28 million MT (SRID, 2020).

Between the years 2010 and 2019, cassava production rose significantly. This growth was attributed to increase in cultivation of the crop, with the amount of land used for this purpose rising from 875,000 hectares to 1,021,000 hectares. In addition, projects such as Roots and Tubers Improvement and Marketing Programme (RTIMP), Alliance for a Green Revolution in Africa (AGRA) and West Africa Agricultural Productivity Programme (WAAPP), which improved access to high-yield and disease-resistant cassava planting materials, helped to increase production levels.

The large-scale processors lately have established their own production lines to feed their processing outfits owing to high demands for their processed products. They include the Caltech Ventures, Amantin Agro Processing Company, Tropical Starch Company, Ayensu Starch Company and others.

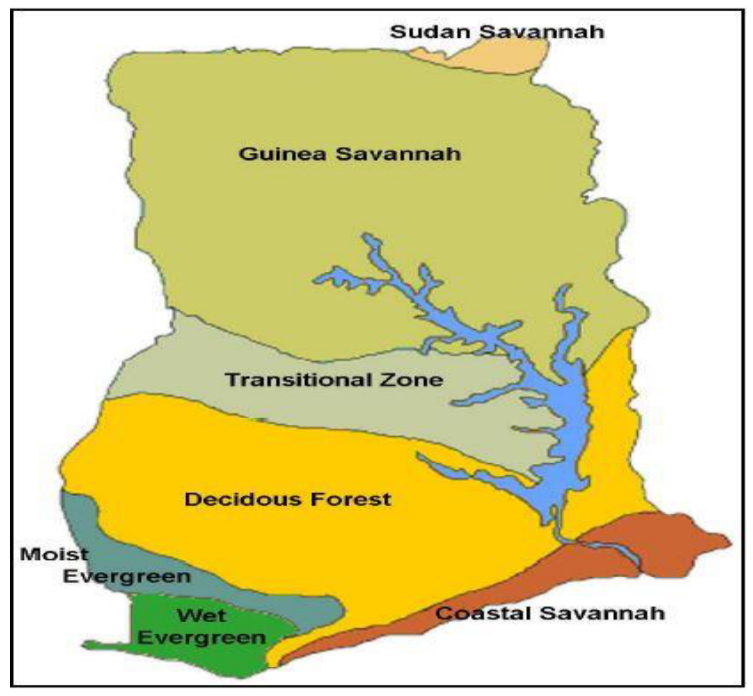

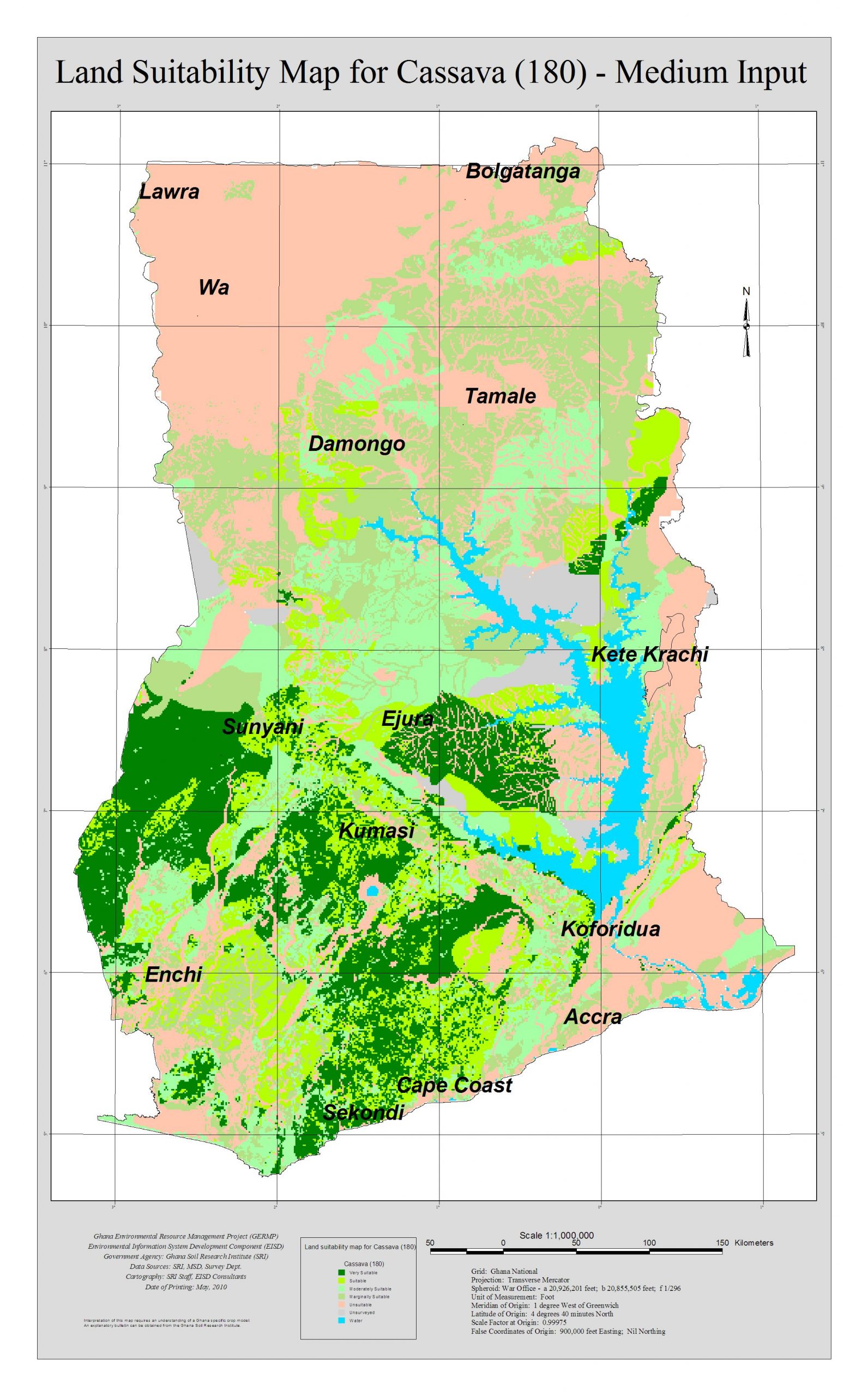

Presently, Ghana ranks among the top five cassava producers in Africa. Cassava is grown in all agro-ecological zones of the country.

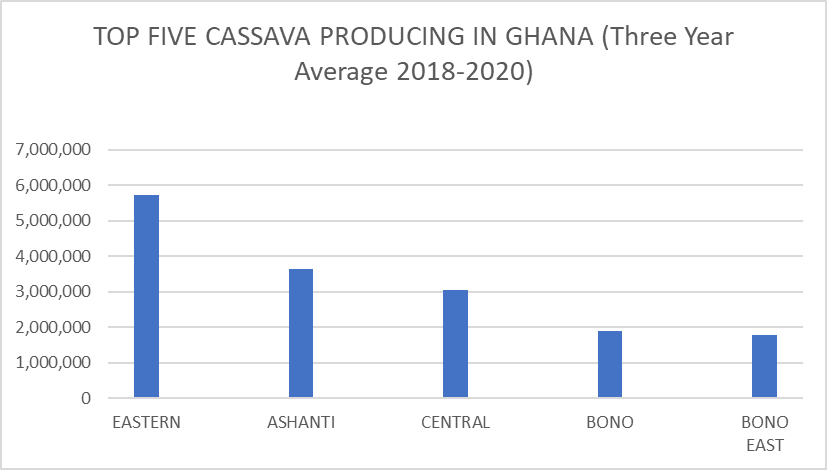

Table 1: Cassava Production (Mt) Statistics (2018 – 2020)

| TOP 5 REGIONS | 3-YEAR AVERAGE (2018 – 2020) | SHARE OF SUBTOTAL (%) | SHARE OF OVERALL TOTAL (%) |

| EASTERN | 5,733,536 | 35.6 | 26 |

| ASHANTI | 3,649,213 | 22.7 | 22 |

| CENTRAL | 3,037,670 | 18.9 | 16 |

| BONO | 1,886,187 | 11.7 | 13 |

| BONO EAST | 1,783,857 | 11.1 | 9 |

| SUB TOTAL | 16,090,463 | 100 | 87 |

Eastern Region remains the leading producer of cassava in Ghana with a share of 26.24% of national total based on a 3-year average production. Brong Ahafo Region follows closely with a share of 22.01%. The 5 top producing regions together, account for 86.68% of total cassava production in the country.

Specifically, the Afram Plains district in the Eastern Region is the leading producer of cassava roots in Ghana, followed by Awutu-Effutu-Senya (Central Region), West Akim (Eastern Region), Fanteakwa (Eastern Region), Atebubu Amantin (Bono East Region), Twifo Hemang Lower Denkyira (Central Region), West Gonja (Savannah Region), Kwahu West (Eastern Region), Atiwa (Eastern Region) and Komenda Edina Eguafo Abirem (Central Region).

Table 2: Production Trend of Cassava in Ghana between 2011 and 2020

Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Annual Production ‘000Mt | 14,240 | 14,547 | 15,990 | 16,524 | 17,213 | 17,798 | 19,008 | 20,846 | 22,750 | 24,368 |

| Annual Area Planted ‘000Ha | 889 | 869 | 875 | 889 | 917 | 879 | 879 | 977 | 1,021 | 1,061 |

| Yield (Mt/Ha) | 16.02 | 16.74 | 18.27 | 18.56 | 18.77 | 20.25 | 21.62 | 21.34 | 22.28 | 22.97 |

Aggregation and trade

The aggregation stage in the chain is or could be carried out by several persons including the producers themselves. Farmers usually harvest and arrange for transport to processors and traders. Cassava collecting centres operate in the Wenchi, Techiman and Central Tongu districts. The location varies from season to season depending on where good harvests are expected. The collection centres are often located on the main roads near the cassava farms which is an attractive solution to high transport cost. Farmers prefer working with intermediaries whose collection points are located close to their farms as it allows them to reduce the transaction costs.

Assemblers/aggregators

Assemblers/aggregators, roam/travel to gather fresh cassava roots from farmers and deliver the produce to the open market or processors. They work in conjunction with transporters who convey fresh produce from farm to processors and finished products from processors to end-markets. The purchased produce are then transported and sold to either wholesalers within district markets, wholesalers who come from large cities like Accra and Kumasi or to processors and chop-bar operators.

Wholesalers

Local wholesalers based in the district market and those who come from urban markets procure cassava roots in larger quantities for onward sale to retailers or processing firms and chop-bars/restaurants. Wholesalers who deal in processed product like gari procure directly from processing centres and transport to destination markets in urban centres (such as Accra, Kumasi, Takoradi etc.) and also to institutional buyers (such as second cycle schools) and training colleges. Some wholesalers also export gari to Europe, the USA and countries in the West African subregion, including Mali, Burkina Faso, Togo.

Retailers

Retailers for fresh cassava practice farm harvest buying, others rather source cassava from wholesalers in the market for onward sale to final consumers. Those who deal with processed cassava products like gari and agbelima may receive supplies either from wholesalers or the processing centre. They handle very small volumes, usually a bag or two, because of poor storage systems and high perishability of fresh roots.

Farmers who plant for semi-commercial purposes supply directly to local processors who make traditional food products and keep 20-50% on average for home consumption. Cooperatives are not particularly common in the cassava industry, though in some places outgrower and block farmer associations have been organized with the help of processors. Some companies have adopted an approach or models to aggregation; eg. The Sinostone Group and DADTCO’s aggregation models combine collection and processing, buying at farm gate and processing to wet cake or chips with mobile processing units.

Processing

Cassava is ubiquitous in Ghana for many reasons. Several food forms, industrial products and even traditional medicines take their roots from the crop. Many of these products have become exportable over the years as a result of advancements in processing technology and the increasing industrial attention.

That notwithstanding, cassava processing in Ghana remains very basic. It is dominated by small to medium scale enterprises (SMEs) accounting for most of the processing for the traditional food market. Rural processing is also common but basic and is organized around individual household food preparation or rural village processing units. Roots are often dried or fermented and converted to food products for home consumption or sale in local markets.

A number of these Small, Medium Enterprises (SMEs) can handle up to 100,000MT per annum. They process High Quality Cassava Flour (HQCF) for use in baking industries (mostly small-scale) and packaged traditional foods (dough, kokonte and gari) for retail sale and even Export Trade. Primary processing of cassava is largely female led into product s like gari, kokonte, agbelima (cassava dough) etc.

Large scale or industrial processing is limited, with volumes of chips, starch, wet cake and ethanol being processed for the breweries and respective industry players. There are a few large processing plants (Amantin Agro-Processing, Caltech Ventures, Amenfi Farms) covering the whole production line of cleaning, chopping into small pieces, milling and making dry or wet starch and ethanol. There are also new industrial processing facilities under construction though not yet operational such as the Sinostone Group. Ayensu Starch Company has been sold out to an investor. The company since 2017 was shut down and has been going through renovation and installation of new and modernized equipment. Full operation of production and processing activities of the company is yet to commence.

Some of the most common economic products from cassava include Gari, Starch, High Quality Cassava Flour (HQCF), Cassava Chips, Cassava Beer, Ethanol and Cassava Leaves.

Consumption and utilisation of cassava

Consumers include all individuals, institutions, and industries that use cassava and its derivatives. Households consume fufu prepared from fresh roots, instant fufu flour and low-grade cassava flour. Schools and hospitals utilize fufu flour and gari, while plywood and alcohol factories utilize starch and industry-grade cassava flour.

___

Key Agronomic Practices

Good Agricultural/Husbandry Practice

| Brief Description and importance |

|---|---|

Planting Material/ Variety Selection  | The basic planting material used for cultivation is stem cuttings. There are a number of varieties that have been developed through research. Varieties are selected based on their distinctive characteristics. The improved varieties are currently being recommended for cultivation by farmers in Ghana. Some of these varieties include Afisiafi, Abasafitaa, Lamesese, Agbelifia, Sikabankye, Bankye Hemaa, IFAD, Amansan Bankye, Nyonku Agbeli, Capevars Bankye, Tek Bankye, Crops Research, Doku Duade etc. Select varieties that would meet the demand or consumers preference. Eg. high yielding, tolerance/resistance to important cassava diseases in Ghana, early maturing etc. Selection of a variety should also be based on weather information and preferred agro-ecology. Always purchase or acquire cuttings from certified seed producers where viability and variety purity can be guaranteed. Where certified seed is not available, you may use cuttings from your own farm for planting.

|

| Coppicing and Planting Material Preparation | Coppicing is the harvesting of matured stems as planting materials for cultivation. Select disease-free and healthy cassava stems for planting. Select the hard-wood portion of stems for the cuttings. Cut planting material 40-50 cm long for purposes of transporting. Avoiding bruising or damaging the nodes of the cassava cutting. Coppiced plant on the field is left to regenerate. |

Choose suitable soils

| Cassava is well adapted to a wide range of soil conditions. For maximum yields and production of a good quality crop, soil conditions should be optimal. Choose level land or land with a gentle slope, wherever you decide to cultivate cassava. A deep and well-drained loamy soil is ideal for maximum productivity. Well-drained soils provide ideal conditions for the proper growth and development of cassava. Avoid areas with steep slopes, sandy and clayey soils. Sandy soils do not retain water after rain or irrigation and expose plants to drought stress, which can cause total crop failure depending on the crop’s growth stage and duration of the drought. Clayey soils are prone to water logging. Clayey soils crust and crack when dry, and damage the rooting system. As a general rule consider the following in selecting a site for cassava production:

|

Agro Climate Conditions

| Cassava is well adapted to a wide range of climatic conditions. For maximum yields and production of a good quality crop, cultivate cassava in an ecology with an annual rainfall of not less than 700mm and well distributed throughout the growing period. In Ghana, cassava can be cultivated in all agro-ecologies and does very well in all regions except for the Upper East region. |

| Land Preparation | Good land preparation is critical for sprouting and plant establishment. It also reduces weed competition. Prepare land such that soil is loose and hence well aerated, has good moisture holding capacity and free of weeds. Land can be prepared conventionally using tractor to plough and harrow. Slashing, followed by stumping, controlled burning of trash and application of systemic herbicides may be practiced in the forest ecologies. To reduce erosion on sloping fields, plough across the slope (contour ploughing). The following practices are worth noting in land preparation:

|

Planting

| Planting is the most critical phase in the establishment of a new crop on a prepared field. Plant timely when rains have stabilized. Planting period may differ according to the agro-ecology, maturity group of variety planted and/or season. Cassava for root production is best planted on ridges in rows or loose soils/flat to improve crop performance, enhance good root formation, and ease weeding and harvesting. Planting in rows at recommended spacing ensures

The spacing used in cassava production is 1m x 0.8 to 1m. Thus, the plant population per hectare may range from about 8,000 to 10,000. Distances between cassava plants mainly depend on the variety and on the cropping system (sole crop or as intercrop). Plant at 1m x 1m (100 cm x 100 cm) or 90 cm x 90 cm if cassava is for sole crop. Plant at wider spacing (greater than 1m x 1m) in mixed cropping. Note that too wider spacing between cassava plants could promote conditions for increased weed competition. Cassava stem cuttings may be planted vertically, at an angle or horizontally, depending on soil type. The recommended length of cuttings is about 20-30cm long. Plant vertically in sandy soils with 2/3 of length of cutting below the soil to produce deeper lying storage roots. Plant at angle in loamy soils to produce more compactly arranged roots. Improper planting methods could lead to poor sprouting and growth for cuttings. Planting dates should fit with local farming calendars. It differs according to the season and agro -ecological zones. In zones with 2 rainy seasons, plant at the beginning of the major growing season (Apr-May) or minor season (August). In the savannah zones, plant at the beginning of the growing season (May-Jun). This ensures healthy sprouting and good crop establishment. |

Pest and Disease Management

| Mealybug, Green mite, Termites, Variegated Grasshoppers and Vertebrate pests are the major insect pests of cassava in Ghana. They are principally dry season pests. These pests can cause considerable damage to cassava and therefore reduce crop productivity. They must therefore be effectively managed through an integrated approach to optimize crop yield. Integrated Pest & Disease Management This involves the utilization of a variety of methods and techniques including: Cultural, Biological and Chemical. It is based on prevention, monitoring and control. The best way to control pests is to grow a healthy crop. Avoid cuttings with stem-borne pests or damage symptoms and treat planting materials with appropriate insecticides. The major diseases of cassava are

These diseases prevent farmers from getting optimum yields. To control or manage these diseases,

|

Soil Fertility Management

| Process of managing the amount, source, timing, and methods of nutrient application. This involves optimizing farm productivity while minimizing nutrient losses that could create environmental problems. It is essential to conduct soil tests to determine the nutrient needs of cassava and make the appropriate fertilizer recommendations. Some of the nutrient management techniques or management options available for use depending on farmers’ circumstances. These include:

Fertilization improves the physical and chemical properties of the soil. In areas where ploughing is done, plough-in leguminous cover crops such as Mucuna to improve the soil physical and chemical properties. Add manure such as cow dung or poultry droppings at land preparation.

General recommendation

Agroecological zone

NPK Recommendation (N-P2O5-K2O)

Recommended Blend (N-P2O5-K2O)

6 bags per hectare (apply as split; 4 weeks after planting and 16 weeks after planting – all spot placement) OR Apply 3-4 bags per hectare or 20g of fertilizer per plant at 4 weeks after planting and 1.5 bags of urea and 1 bag of Muriate of potash mixed as second application at 16 weeks after planting – spot placement and covered. |

Weed Management

| Weeds compete directly with plants and reduces yield. Practice of managing weeds that damage agricultural crops is very essential. Such measures include:

NB: The use of weather information and early warning systems guides farmers on the choice of appropriate crop protection measures to adopt against weeds.

Weed competition reduces canopy development and root bulking. Weeds also reduces the quality of planting materials, harbor pests and diseases, obstructs farming activities etc. Therefore:

NB: Always use protective clothing when spraying

Weed control is most successful when it involves an integrated approach using a variety of methods. There are 4 types of weed control measures, which are commonly used in cassava production; Preventive, Cultural, Chemical and Mechanical. However, the most effective ways to control weeds are:

|

Cassava Cropping Systems

| Mono-cropping Growing one crop on the same field is usually referred to as mono-cropping or sole cropping. Cassava is commonly grown under sole cropping by medium to large scale farmers but small-scale farmers sometimes intercrop with cereals and legumes. Sole cropping is advantageous because the correct plant population per unit area is achievable. In addition, it is easier to mechanize field operations in sole cropping systems. This makes sole cropping more compatible with large-scale production systems. Cultural practices such as, weed control and pesticide application are much easier in mono-cropping system. However, in the event of an outbreak of diseases and insect pests, total crop loss may occur. Intercropping When two or more crops are inter-planted on the same field such that their growth cycles overlap, the cropping system is called intercropping. Farmers usually intercrop legumes with root and tuber crops in many areas of Ghana. Cassava soybean intercrop is a highly productive system and is recommended. Plant cassava two weeks after planting soybean as follows: alternate two rows soybean with single rows of cassava spaced at 50cm, using within row spacing of 1m for the cassava and 10cm for the soybean, 2 plants/hill. This system has the potential to give comparable yields to those of sole crop cassava with the soybean yields as bonus. Crop rotation Two or more crops grown alternately on the same land can result in significant yield improvement. Cassava is a favourable crop after maize, soybean, and sorghum. The success of this system depends on the choice of crops, use of suitable varieties, cropping sequence and management practices. Advantages of crop rotation include:

|

Harvest Management

| Harvest early or at the right time to avoid field losses. Timely harvesting and post-harvest operations in cassava is very important to maximize yields, minimize postharvest losses and quality deterioration. The use of weather information is important in timing harvesting. Harvest as soon as the roots are matured. Optimum time for harvesting varies according to the variety, climate and soil factors. The varieties released in Ghana could be harvested between 10 and 15 months after planting. Delayed harvesting may result in fibrous or rotten cassava roots. Harvest cassava either manually (by hand) or mechanically (by machine e.g. cassava harvester). Cassava harvester is efficient on ridges and when the weather and soil conditions are dry. Manual Harvesting In Ghana, most farmers harvest cassava manually because their farms are usually small (0.25 to 2 ha) and also practice mixed cropping. Mechanical Harvesting Commercial large-scale farmers use cassava harvester on their fields. This practice is advantageous because it saves time and reduces the drudgery farmers go through to harvest. Harvesting of Planting Materials Cassava planting materials are ready for harvesting when materials reach 7-12 months after planting depending on the variety and environmental factors. Coppice planting materials 25cm or more above ground. Coppice again after 7-12 months. Coppice planting materials only when needed.

|

Post-Harvest practices

| Processing and Storage

Processing Key step to managing post-harvest losses are critical as roots are highly perishable due to their moisture content at harvest. Cassava can either be primary or secondary processed.

Storage This involves holding and preserving produce from the time of harvesting until they are needed for consumption. Storage protects the quality of produce from deterioration thus the storage environment for cassava and its processed products should be cool and dry to avoid accumulation of moisture to prevent or slow deterioration.

|

___

Key Risks Along the Value Chain and Mitigation Measures

| Value Chain Actions | Key Risks and Challenges | Mitigation Measure |

|---|---|---|

Input Supply

| Limited availability and access to improved planting materials | - Establishment of Community Seed-based (cassava planting material) Multiplication

- Establishment of rapid multiplication techniques (two-node technology) at the MOFA agricultural Stations to increase base of improved breeder materials.

- Train farmers and entrepreneurs to engage in secondary and tertiary planting material multiplication. |

| Lack or inadequate planting and harvesting logistics | Financial institutions could support the funding of fabrication of cassava planter and harvester prototypes to reduce drudgery during land planting and harvesting. | |

| Finance | Inadequate/Lack of access to financial support and facilities from the banks and financial institutions

| - Financial institutions can support the

- Sensitization of farmers on agricultural related financial packages or loans by respective banks

- Link stakeholders along the value chain to Financial Institutions.

- Training actors especially producers and processors to develop bankable proposals/business plans.

- Create strong linkages among actors to establish trust in their respective lines of operations.

- Asset financing of processing segment of the value chain.

|

High interest rates

| - Provision of incentives (eg tax waivers, credit guarantee)

- provision of Interest subsidies

| |

| Production | Low yield due to use of inferior landraces (unimproved varieties)

| - Training and adoption of Good Agricultural Practices (GAPs).

- Adoption of certified and cleaned, improved planting materials.

- Encourage the establishment of seed multiplication.

- Financial Institutions to support the development of more improved varieties to meet market demands.

|

Increased pest and disease incidence especially viral diseases

| - Select and use disease tolerant varieties

- Altering planting dates

- Use of IPM technologies | |

| Declining soil fertility | - Carryout soil testing or consult crop-soil suitability map.

- Use appropriate recommended plant and soil nutrition.

- Practice crop-livestock farming system if possible.

| |

| Low commercialisation of production | Finance through Farmer-based Organizations (FBOs) based on track record.

| |

| Non-adoption of improved technologies /Good Agronomic Practices (GAPs) | - Extension education on GAPs

- Carryout on-farm demonstrations and field days

| |

| Post-harvest handling | Poor storage facilities/high produce perishability

| - Financial institutions to support further research on the improvement of commodity shelf life.

- Support the diversification or processing of cassava into other products.

- Grading and sorting

- Creation of a common platform to establish strong linkages between producers, processors and industrial consumers.

|

| Marketing | Increased/high price of produce because of high demand from different sectors | - Encourage contractual agreement among actors along the chain

- Government support required for crop intensification to increase scale of production and to satisfy varied end users

- Produce appropriate and suitable varieties for respective markets

|

| inability to sell the cassava products (cassava roots, cassava chips or flour) due to poor price offer at certain periods of the season | Purchases should be backed by an off-taker contract from a reputable party at an agreed quality-related price | |

Cyclical glut

| - Create strong linkages among actors especially producers and processors.

- Encourage staggering of planting | |

| Processing | Capital intensive for medium-large scale industrial processing.

| - Government to subsidize machinery and major activities of medium-large scale processors

- Banks to support largescale processors linked to organised producers or FBOs

|

Limited product varieties/value addition meeting consumer preference

| - Encourage product diversification

- Empower women to be effective in the aggregation and processing along the chain | |

| Environmental challenges with the disposal of effluents from processing sites | Support processors to develop and Environmental Management Plan (EMP) for large scale processing plants or outfits

| |

| Consumption | High demand and competition from the breweries and neighbouring countries

| - support promotion towards the development of varieties and specific varieties for industry.

- Government support required for crop intensification to increase scale of production.

|

___

Major Pests & Diseases

Common Cassava Pests

- Cassava Mealybug (CM)

Cassava mealybug is a 2-3 cm long pink colored insect whose body is covered with wax producing pores. Cassava mealybugs spread especially in hot season by wind and planting infested cuttings from infected field. Mealybugs attack the growing tips, causes bunchy tops shorten internodes and produce sooty moulds.

Symptoms of Cassava mealybug

Management/Control

- Grow tolerant varieties.

- Use clean planting materials and plant on time when the first rains start.

- Use neem oil insecticides applied directly on mealybugs. This can provide some suppression, especially against younger nymphs that have less wax accumulation.

- Cassava Green Mite (CGM)

Cassava green mite is transmitted by a green acaridian called Mononychellus tanajoa which inflicts heavy damages to cassava fields during dry seasons. Cassava green mite sucks sap from cassava leaves and shoot tips. The pest causes tiny yellow chlorotic spots the size of pin pricks, on the upper leaf surfaces. You should not confuse chlorotic spots caused by the pest with the chlorotic patches of cassava mosaic disease. Young leaves attacked by cassava green mite become small and narrow (deformed and reduce in size). The pest kills the terminal leaves and as these drop the shoot tip looks like a “candlestick”. Cassava crop damage by the pest is more severe in the dry than in the wet season.

Symptoms of Green Mite attack

Management/Control

Regulatory Control

Close inspection of stem cuttings and the use of clean certified cuttings may reduce the spread of M. tanajoa and delay the time of infestation of the cassava crop.

Cultural Control

Early planting at the onset of the rains to encourage vigorous growth and thereby increase tolerance to mite attack.

- Bemisia whitefly

The whitefly, Bemisia tabaci, is a major pest of cassava, particularly in Africa where it is responsible both for the transmission of plant viruses and increasingly, for direct damage due to feeding by high populations.

Presence of whitefly on cassava leaves

Bemisia whiteflies suck sap from the leaves, but this does not cause physical damage to the plant. As they feed, the insects inject the plant with viruses which cause cassava mosaic disease. This is the main reason why the insect is an important cassava pest.

Management/Control

- Use of clean and certified cuttings for planting.

- Practice intercropping or crop rotation.

- Introduction of natural enemies (Regarding predators, Phytoseiidae mites, such as Euseius scutalis, have been recorded predating B. tabaci populations on cassava in Kenya).

- Grasshoppers (eg. Variegated grasshopper)

The variegated grasshopper chews cassava leaves, petioles, and green stems. It defoliates the plants and debarks the stems. The pest damage is more common on older than on younger cassava plants, and is more severe in the dry than in the wet season.

Management

- Hand pick any grasshoppers found on plants;

- Locate any egg pods around cassava field and destroy to reduce grasshopper populations;

- Biopesticides such as "Green Muscle" are available in and effective at reducing the grasshopper population;

- Products containing neem have also given good control of variegated grasshoppers

- Vertebrate Pests

The common vertebrate pests of cassava are birds, rodents, monkeys, pigs, and domestic animals. The bird pests are usually bush fowl or francolins (Francolinus sp.) and wild guinea fowl. These birds feed on storage roots that have been exposed. They also scratch the soil surface to expose the storage roots. The remaining portions of the attacked roots later rot.

Birds are particularly a problem where cassava is planted in soils that are loose and easy to scratch away.

The major rodent pests of cassava are the grasscutter or cane rat (Thryonomys swinderianus), the giant rat (Cricetomys gambianus), other rats, mice, and squirrels. Among these, the grasscutter causes the greatest damage to cassava. It cuts down and chews the stems, and also feeds on the storage roots.

Pigs dig, uproot, and feed on cassava storage roots. Monkeys damage cassava in a similar manner. Cattle, goats, and sheep defoliate cassava by eating the leaves and green stems.

Management

Some actions to take includes:

- Keeping your farm free from weeds. weed cassava farms on time and slash weeds and vegetation around the farm to discourage grasscutters and other rodents;

- Clearing weeds within the immediate vicinity of the farm to destroy the hiding places of pests.

- Using baits such as Phostoxin to control rodents.

- Create fence where necessary to prevent animals invading the farm or field

- Set traps in the fence against grasscutters and other rodents;

- Grow “bitter” cassava varieties where pigs and monkeys are a severe problem; pigs and monkeys prefer “sweet” cassava varieties;

- Harvest cassava storage roots as soon as they are mature; this will reduce the length of time they can be exposed and damaged by the pests

Common Cassava Diseases and Control

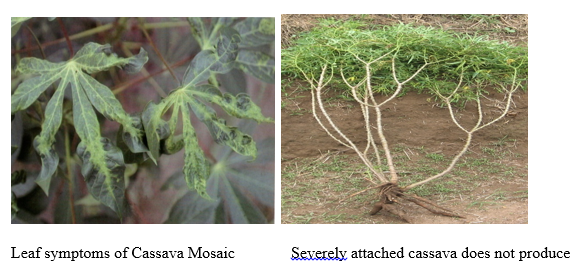

- Cassava Mosaic Disease (CMD)

The disease is transmitted by a virus called Cassava Mosaic Virus (CMV). This virus is spread by a kind of fly called “Bemisia tabaci’’. The disease is widespread across Africa.

Attacked leaves have irregular yellowish spots. Leaves deform, blister, become narrow and shrivel up. There are also signs of stunting.

Control

- Uproot any plant on which symptoms of the disease are identified.

- Plant timely

- Using healthy cuttings from resistant species and from healthy plantation.

- Ensure appropriate management of the plantation.

Symptoms of CMD

- Cassava Bacterial Blight (CBB)

Xanthomonas axonopodis is the pathogen that causes bacterial blight of cassava. Symptoms include blight, wilting, dieback, and vascular necrosis. A more diagnostic symptom visible in cassava with Xanthomonas axonopodis infection are angular necrotic spotting of the leaves—often with a chlorotic ring encircling the spots.

These spots begin as distinguishable moist (dark water-soaked patches), brown lesions normally restricted to the bottom of the plant until they enlarge and coalesce, often killing the entire leaf.

There are signs of wilted leaves and severe defoliation (leaf drop) even in the wet season. Shoot or stem dieback

- Cassava Brown Streak Virus Disease (CBSVD)

This is a damaging disease of cassava plants, and is especially troublesome in East Africa. It was first identified in 1936 in Tanzania, and has spread to other coastal areas of East Africa, from Kenya to Mozambique.

CBSD is characterized by severe chlorosis and necrosis on infected leaves, giving them a yellowish, mottled appearance. Leaf symptoms vary greatly depending on a variety of factors. The growing conditions (i.e. altitude, rainfall quantity), plant age, and the virus species account for these differences.

Brown streaks may appear on the stems of the cassava plant. Also, a dry brown-black necrotic rot of the cassava tuber exists, which may progress from a small lesion to the whole root. Finally, the roots can become constricted due to the tuber rot and stunting growth.

Symptoms of CBSVD on Cassava leaves and root

- Cassava Anthracnose Disease (CAD)

This is a fungal disease. Affected plants show the following symptoms:

- Cankers on stems and leaf petioles.

- Leaves drooping downwards

- Wilting leaves which die and fall from plant leading to plant defoliation

- Death of shoots

- Soft parts of plant become twisted and distorted.

Disease emerges at the beginning of wet season (Africa) and worsens. Spores spread by wind.

Severe anthracnose infection on stem

Anthracnose canker on cassava stem

Management/Control

- The most reliable control measure is to use desired anthracnose resistant/tolerant varieties particularly in localities with high CAD pressures.

- Avoid planting cuttings with cankers; use healthy planting materials

- Stems and leaves from infected plants after harvest must be destroyed by burning to reduce the amount of fungal spores and other infective structures that can cause infections in the next generation of plants.

- The fungus that causes cassava anthracnose can also cause diseases on other food crops such as pepper, avocado, banana, pawpaw and yam. Spores therefore can be transferred from these plants to cause infections in cassava. Plant debris from plants suspected to be harboring the anthracnose causing fungus must be destroyed by burning, particularly during land preparation before cassava is planted.

General Control measures for Cassava diseases and pests

- Grow tolerant varieties

- Use clean planting materials and plant on time when the first rains start

- Roguing

- Training (educating farmers/users)

- Strict quarantine regulations

- Biological control (natural enemies)

- Exchange of germplasm with tissue culture plantlets

- IPM (Integrated Pest Management)

___

Market

Market Opportunities for Cassava Products

PRODUCT | CURRENT SUPPLY (MT) | CURRENT DEMAND (MT) | DEFICIT (MT) | INDUSTRY/END USE | COMPANIES IN PRODUCTION |

| Starch | 1,320 | 10,800 | 9,480 | Brewery Industry Mosquito Coil Industry Pharmaceutical Industry Confectionery Industry | Ayensu ASCO Tropical Starch Co. Ltd |

| Ethanol | 3M Lt | 83 M Lt | 80M Lt | Distillery Companies Hospitals | Caltech Ventures |

| High Quality Cassava Chips (HQCCs) | 4,000 | 30,000 | 26,000 | Animal feed: Poultry Feed, Piggery | Caltech Ventures |

| HQCF | 1,428 | 11,280 | 9,852 | Flour Mills Breweries 2nd Cycle Institutions Food Production | Vankharis Company Ltd

|

| Industrial Grade Cassava Flour | 480 | 10,000 | 9,520 | Paperboard Industry Plywood Industry Glue Manufacturers |

Source: GICSP, 2018

Some Off-taker Companies in Ghana

- Guinness Ghana Limited (Starch)

- Accra Brewery Limited (HQCF)

- Kasapreko Distilleries (Ethanol)

- Sinostone Bioethanol Manufacturing Limited (Ethanol)

- TIAST Group (Starch)

- Other Beverage Bottling Companies

- Promasidor Ghana Limited,

- Ghana Cartons and Manufacturing Limited,

- Pallet noodles

- Olam (Tasty tom tomato paste)

- Pharmaceutical industry

Marketing and Consumption (Utilization of Cassava)

In recent times, cassava production represents a significant opportunity with more demand than supply globally. The growing demand for cassava has made the cassava sub sector a very lucrative business with diverse and growing markets. In Ghana, exports of cassava and or its processed products is very low as domestic demand by processors and home consumption absorbs approximately 70% of all the local produce. The remaining 30% goes into animal feed preparation and wastage (Table 4). Most cassava is subsistence food, largely in the form of traditional products like kokonte and gari. Many households also dry cassava chips for direct sale in local markets, or market small quantities of flour or other processed food products.

Traditional Uses

- Food: Fufu, Agbelima, Gari, Kokonte (Cassava Flour), Ampesi

- Feed: Peels, dried chips, cooked roots

Industrial Uses

- High Quality Cassava Flour (HQCF) – Bakery, Confectionery, Breweries

- High Grade Food Starch (HGFS) – Breweries, Food Processing

- Industrial starch – Paperboard, Textile, Biodegradable products

- Ethanol (Extra Neutral Alcohol) – Pharmaceuticals, Breweries

- Glue Extenders - Plywood industry

- Glucose Syrup – Pharmaceutical & Confectionery industry

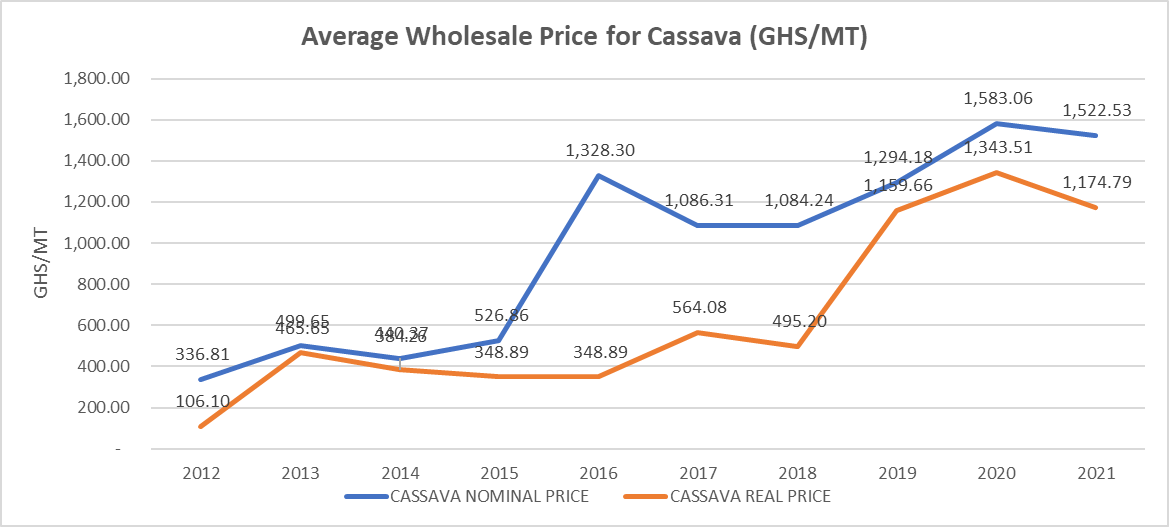

Price Trends

Market for Starch

Potential growth at current top export destinations

GEPA 2019 database informs that, with 7 market destinations, export of Cassava Starch from Ghana increased from US$ 843,000 in 2017 to almost US$1 million in 2018. USA and Italy are the top two (2) largest export destinations for Ghana, with import value of US$935,000 and US$27,000 respectively. The two-trade partners accounted for about 96.4% of Ghana’s total cassava export in 2018. Other significant importers of cassava from Ghana were Belgium (US$24,000), Germany (US$6,000) UAE (US$3,000) and Finland (US$2,000). Between 2014 and 2018, exports from Ghana to the USA, Belgium and Germany were 38%, 43% and 22% respectively with a decline in Ghana’s exports to South African (-7%).

Potential New Market

Global demand for cassava starch has hovered between US$1.58 bn and US$1.43 bn since 2015 to 2017. In 2018, demand was estimated at US$1.77 bn. China was the largest importer of the product with an estimated import value of US$938 million. Other notable global importers were Indonesia (US$185.6m), Taipei Chinese (US$138.1m), Malaysia (US$123.6m), USA(US$82.2m), Japan (US$58.5m) and Philippines (US$54.4m) of the top 6 importers, Malaysia’s imports value of cassava starch grew averagely by 13% between 2014 and 2018. Beyond the notable importers of Ghana’s cassava starch, new and potential markets with attractive and positive growth rates for market diversification and penetration by Ghanaian companies and TPO’s are Poland, Nigeria, Portugal, Italy and Malaysia (GEPA. 2019).

___

Enterprise Budget for Cassava

Production of One Hectare Cassava under Rain-Fed Condition Estimated Crop budget for Cassava

| No. | Activity | Cost per Hectare (GH¢) rain-fed | ||||

| Qty. / Freq. | Unit cost | Total cost | ||||

| 1 | Land preparation | Land Clearing | 1 | 200.00 | 200.00 | |

| 2 | Ploughing | 1 | 200.00 | 200.00 | ||

| 3 | Harrowing | 1 | 150.00 | 150.00 | ||

| 4 | Crop establishment | Planting Material | 100 bundles | 10.00 | 1,000.00 | |

| Planting Material preparation and Planting | 1 | 500.00 | 500.00 | |||

| 5 | Weed management | Pre-emergence herbicide | 2.5 lts | 50.00 | 125.00 | |

| 6 | Application cost | 1 | 100.00 | 100.00 | ||

| 7 | Weeding with Hoe (3 times) | 3 | 150.00 | 450.00 | ||

| 8 | Fertilizer management | NPK | 6 bags | 130.00 | 780.00 | |

| 9 | Application cost | 6 | 100.00 | 600.00 | ||

| 10 | Harvest (manual uprooting) | 22 tons | 60.00 | 1,320.00 | ||

| 11 | Transportation | 1 | 1,000.00 | 1,000.00 | ||

| Production cost | 6,425.00 | |||||

| 5% Contingency | 315.25 | |||||

| Total Production Cost | 6,746.25 (A) | |||||

| Total Revenue (roots) | 22,000 kg (22 Mt/ha) | GH¢ 115 per 91 kg | 27,802.19 (B) | |||

| Net revenue (A-B) | GHS 21,181.94 | |||||

Assuming an average yield of 22 Mt per hectare

| ||||||

___

Cassava Growing Seasons and Cropping Cycle

Agro-ecological Zones of Ghana

Source: Germer and Sauerborn, 2008

___

Industrial and Commercial Uses of Cassava

Industrial use of Cassava

Despite widespread subsistence cultivation of cassava, especially in Africa, the crop’s derivatives have enormous potential for use in industrial processing. Given its versatility and high starch content, cassava can be transformed into many important products. Cassava’s derivatives can be broadly categorized into four product areas: cassava chips, high quality cassava flour (HQCF), starch and ethanol (see Figure below).

Cassava and Derivatives

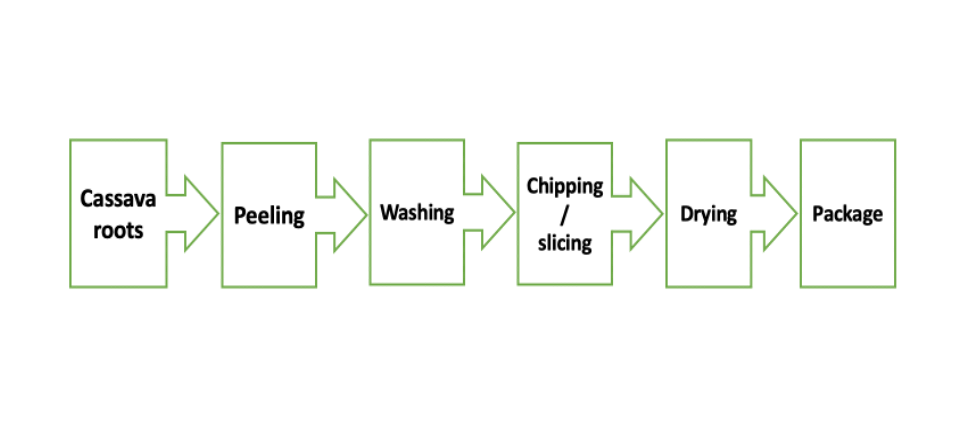

Cassava chips

They are commonly used to produce animal feeds domestically. Chips also account for most cassava traded internationally, as they are stable intermediary product that can be shipped and then converted to final products like starch and ethanol. The use of dried cassava in animal feeds and export of dried chips are opportunities that may drive growth in demand for cassava.

A study carried out by the University of Greenwich, National Resources Institute, 2014 on the subject “Unlocking Private Sector Investments within the Cassava Value Chain” revealed the following:

Animal rearing industries in Ghana are relatively under-developed, though both poultry (layers) and piggery industries have high potential for growth. Feed millers remain uncertain about substituting cassava for maize but are open to the possibility given fluctuating maize prices. Substitution of 16% of the maize used in layers’ feed for cassava would drive demand for 75,000 MT of cassava chips per year. Demand for pig feed is estimated at 3,000 MT per annum. Animal feed opportunities were de-prioritized in this study for two reasons:

- most animal feeds are already made from local produce, so substituting cassava for maize does not necessarily have a net effect on smallholder farmers; and

- most animal feed producers use the cheapest input options at any point, thus when maize prices are low, use of cassava is likely to drop; this inconsistent demand suggests a lower-impact opportunity for farmers.

Global demand for chips is growing quickly, largely driven by Chinese imports for use in bio-ethanol production. A few suppliers in Ghana have begun negotiating supply contracts, mainly with Turkish and Chinese off-takers. Demand for shipments averages 1,000 MT or higher. However, chip export opportunities are also de-prioritized in this study given very low prices offered by exporters. Depending on the amount of processing done (e.g., peeled, type of drying, etc.) prices range widely from $70 per MT at farm gate to $215 per MT FOB (reflecting the high transport costs). At these prices, export is likely only profitable for large-scale commercial farmers who can produce at significantly lower unit cost. Some processors also noted that chip export can be a good stopgap measure to build supply chains while factories are being constructed.

Caltech Ventures, Amenfi farms and a few individuals are engaged in the production of the cassava chips in the country.

Cassava Chip Preparation

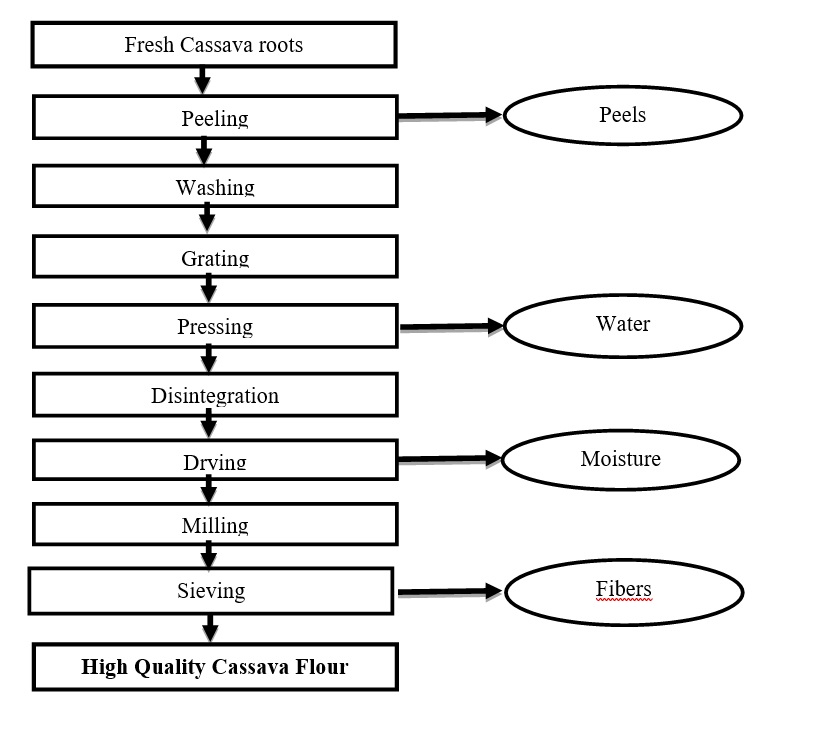

High-quality cassava flour (HQCF)

This is utilized largely as a composite flour for bread, biscuits, snacks and pasta. In a few instances HQCF is also used as a glue extender in the production of plywood, when it is available at a lower cost than other flours.

Work carried out by Cassava: Adding Value for Africa (C:AVA) project in 2015 revealed that Ghana’s annual wheat and wheat flour imports were reported at approximately 446,000 MT in 2014. About 70% of this wheat flour is used in the production of bread. An estimated 12% is used for biscuits, 10% for pasta and noodles, 6% for snacks, and 2% for the plywood industry. This study considered the HQCF as a potential substitute for wheat in products like bread, biscuits, snacks, and pasta.

It is estimated that approximately 3 to 5 SME processors are involved in HQCF production, with installed capacities ranging from 2.5 MT/day up to about 30 MT/day. The total estimated installed capacity is 10,000 MT per year, with utilization of approximately 30% in 2014 (approximately 3,000 MT of HQCF production). Using reasonable caps on substitution for wheat flour by product, the total current market size for HQCF is estimated at 66,000 MT. Estimate of total current market size assumes 10% feasible substitution in bread, 20% in biscuits, 50% in snacks, 5% in pasta & noodles, and 100% in plywood.

The main end-users of HQCF today are informal baking industries (including bread, biscuits, and snacks), the plywood industry, and to a lesser extent, the brewery industry. Bread and other baking industries accounted for about 70% of all demand, or about 2,100 MT of HQCF in 2014.

Again, C:AVA’s Cassava Market and Value Chain Analysis showed Ghana’s plywood sector as well established and serves the local and broader West African market. Plywood companies use cassava flour (an industrial flour that is lower quality than the food-grade HQCF) as a glue extender as a substitute for wheat flour when available at a lower price.

Breweries have recently expressed interest in using HQCF for cassava beer production as a substitute for cassava cake due to persistent equipment challenges that have arisen due to the fibre content in cake. The beer manufacturers however note a preference for starch as the main input for beer production, given its very low fibre content. HQCF is not likely to be a sustained input, and thus demand from breweries is not factored into growth projections.

Vankharis Company Limited, Achienet Company Limited and a few individuals are involved in the production of HQCF in the country.

C:AVA projected in their report that, the demand for HQCF will grow to about 15,000 MT by 2021, representing 15% adoption of feasible HQCF substitution and 2.2% of all flour consumption. Bread and plywood industries are expected to be the key drivers of this growth, each accounting for 40% of the total demand.

Processing of High Quality Cassava Flour

Risks, challenges and way forward

Efforts are needed to address key risks and perceived challenges among industry players. The first risk, especially for large industrial processors, is in securing a sustained supply of cassava roots, given scattered farmers and relatively low yields. Secondly, large millers are apprehensive about legislation that would mandate HQCF inclusion, given that supply volumes have not been adequately demonstrated. Third is the challenge of low levels of awareness among millers, many of whom are reluctant to incorporate HQCF for their baked products due to an underlying negative perception that cassava produces lower quality bread. The key challenge to encouraging greater uptake in the plywood sector is in price competitiveness. The price offered by industry players for industrial grade cassava flour can be as low as 50% of the usual HQCF market price. Lastly, the price competitiveness of HQCF as substitute for wheat flour in various sub-sectors is difficult to prove given fluctuations in wheat prices, especially given multiple potential sources of imports.

Several key stakeholder meetings have been held and advocated for the development and passage of a policy on the use of HQCF in bakery products. An inter-ministerial team being spearheaded by Ministry of Trade and Industry has been tasked to put a framework together towards the formulation of the HQCF inclusion policy.

Starch

This product is used extensively in the food and beverage industry (manufacture of culinary cubes, powered drink products, and others). Starch is also utilized in the pharmaceutical, textile, adhesives and paper/corrugated board industries. When processed further, native starch can be converted to modified starches like glucose (and related sugar syrups maltose and fructose), sorbitol and dextrins.

One time state-owned company, the Ayensu Starch Company used to be the sole processor of starch, with an installed capacity of about 22,000 MT of starch per year. Current utilization rate is only at 5% having produced an estimated 1,100 MT of starch in 2014. The company since 2017 stopped operation and has been sold out to an investor. Production is expected to commence by close of August, 2021 with newly installed machinery. One other private company, Tropical Starch Co. Ltd is currently processing at a low installed capacity of 5 MT per day. The company is seeking for support from the Exim Bank, 1D1F programme and UNIDO to upscale both production and processing activities to serve targeted markets. Amantin Agro-processing Company Limited under the 1D1F facility will also commence processing activities with an installed capacity to produce 300 MT of starch per day.

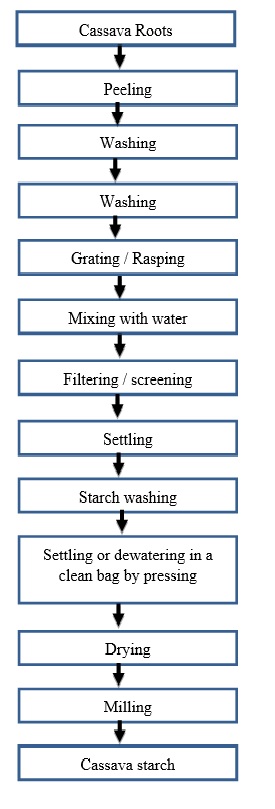

Processing of Cassava Starch Preparation

Potential growth at current top export destinations

GEPA 2019 database informs that, with 7 market destinations, export of Cassava Starch from Ghana increased from US$ 843,000 in 2017 to almost US$1 million in 2018. USA and Italy are the top two (2) largest export destinations for Ghana, with import value of US$935,000 and US$27,000 respectively. The two-trade partners accounted for about 96.4% of Ghana’s total cassava export in 2018. Other significant importers of cassava from Ghana were Belgium (US$24,000), Germany (US$6,000) UAE (US$3,000) and Finland (US$2,000). Between 2014 and 2018, exports from Ghana to the USA, Belgium and Germany were 38%, 43% and 22% respectively with a decline in Ghana’s exports to South African (-7%).

Potential New Market

Global demand for cassava starch has hovered between US$1.58 bn and US$1.43 bn since 2015 to 2017. In 2018, demand was estimated at US$1.77 bn. China was the largest importer of the product with an estimated import value of US$938 million. Other notable global importers were Indonesia (US$185.6m), Taipei Chinese (US$138.1m), Malaysia (US$123.6m), USA(US$82.2m), Japan (US$58.5m) and Philippines (US$54.4m) of the top 6 importers, Malaysia’s imports value of cassava starch grew averagely by 13% between 2014 and 2018. Beyond the notable importers of Ghana’s cassava starch, new and potential markets with attractive and positive growth rates for market diversification and penetration by Ghanaian companies and TPO’s are Poland, Nigeria, Portugal, Italy and Malaysia (GEPA. 2019).

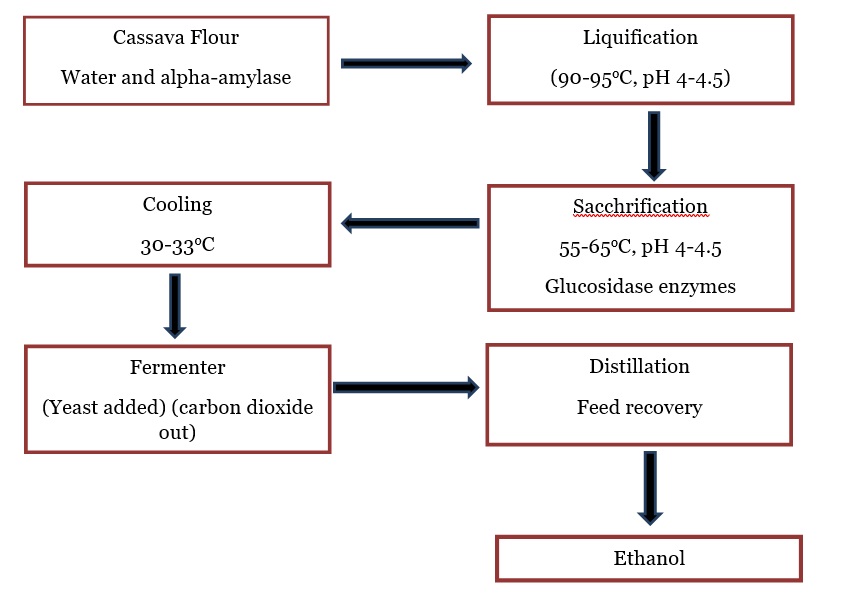

Ethanol

This is used largely in the spirit distilling industry. Its potable form, extra neutral alcohol (ENA), is blended with water and other flavours to make many alcoholic beverages. Ethanol can be used as a fuel, both for cooking and for blending with gasoline in vehicles. Ethyl alcohol is used in the medical and industrial sectors as a sterilizer and in the pharmaceutical sector as an ingredient in certain medication formulas.

According to “Ghana Food and Drink Report,” BMI Research, 2015, all of Ghana’s ethanol is currently imported. Annual domestic ethanol imports are estimated at 60 million litres, with approximately 97% utilized in the potable ethanol (spirits) sub-sector. Regional ethanol demand in 2013 for ECOWAS was 16 million litres, giving a total domestic and regional demand of 76 million litres.

The main end-users of ethanol are spirits companies, who blend potable ethanol (also known as extra neutral alcohol or ENA) with water and flavors to produce alcoholic spirit beverages. Pharmaceutical industries account for a small part of the ethanol market, with ethyl alcohol being used widely as a solvent and vehicle in production of medications. Ethanol is also important in various industrial activities as a sterilizer and as a fuel for cook-stoves or vehicles (blended with gasoline).

Currently, only Caltech Ventures is engaged in ethanol production in the country with support under the 1D1F facility producing at an annual capacity of about 3 million litres (10,000 litres per day). Another company (Sinostone Bioethanol Manufacturing Limited) is almost completed and expected to begin operations by October 2021 in the production of ethanol from cassava. It will be producing at an installed capacity of 50,000 litres per day (15 million litres per annum).

The domestic and regional demand for cassava ethanol is expected to reach approximately 30 million litres by 2022. Meeting the demand of 30 million litres and more per year suggests the need for investment in at least three new large ethanol factories averaging 9 million litres per year by 2021. Investment required is $20-30 million for each facility. Alternatively, at least nine smaller facilities would be required, averaging 3million litres per year to meet the same demand. Investment required for the smaller facilities is estimated at $3-5 million. Total investment required by 2021 is therefore between $36-75 million.

To fully capitalize on this opportunity, players must address a number of challenges. First is the challenge posed by the relatively high costs of setting up an ethanol processing facility as compared to other cassava end-products. This ultimately underscores the importance of optimizing operations through high utilization of installed capacity. Secondly, given the high initial investment, it is crucial that strong supply-chain management strategies be put in place in order to manage outgrowers and ensure adequate volumes of fresh cassava reach the factory. Finally, price competitiveness of locally-produced ethanol is critical. Fluctuations in the market price of cassava create additional risks for businesses, as the market price of ethanol must remain relatively stable to induce end-users to adopt the local alternative.

Meeting this demand for industrial uses of cassava can have enormous economic and social impacts, with an estimated $20 million worth of cassava being supplied annually for industrial use. It is projected that Ghana will require approximately $200-300 million as investment in additional processing capacity which would double incomes for an estimated 50,000 smallholder farmers and lead to savings from wheat, starch, and ethanol imports worth $34 million.

In general, trade opportunities exist for cassava products, however, Ghanaian exporters have not been able to take full advantage of this potential. Much of the excess cassava which is either wasted or remains unharvested can be captured for industrial use thus reducing the deficit in demand of processed products without any effect on food security (table 3). Ghana has also had successful past experience with industrial uses of cassava following a thriving cassava chip export business to Europe in the 1980s. Presently, a number of investments in ethanol and starch suggest the growing potential to add value to cassava. These investments are likely to catalyse increased interest in improving the value chain to promote growth. The breweries, ethanol production for spirits and starch processing for export are new and developing markets in the cassava value chain. Production is however on small scale and are expected to expand in the near future.

Cassava to Ethanol Processing Flow

___

Soil Suitability Map for Cassava

___

Other Cassava Resources

Crop Enterprise Budget 2019

This current crop Enterprise Budget (CEB) which covers 5 major commodities; maize, rice, cassava, pepper and tomato (also yam) have been developed by the Statistical Research and Information Directorate (SRID) of MoFA for the 2019/2020 cropping season to assist prospective investors in crop production, producers and other agricultural stakeholders in evaluating expected cost and returns for selected crops in the upcoming cropping season (2020/2021). The crop budget estimates are also expected to serve as a tool for producers and their credit providers in enterprise selection and financing.

Facts and Figures- 2020 Agriculture in Ghana

Agriculture Facts and Figures 2020

Crop calendar for all Agro-Ecological Zones

Generates Crop calendar for Cereals, Legumes, oil crops and sugars, vegetable, Root/Tubers for all agro ecological zones in Ghana.

Weekly Commodity Market Prices- Week ending March 11- 2023 (2nd Week March)

The attached information contains weekly prices of various food commodities collected from major markets in Ghana.

___

Email: Comms@agricinafrica.com

Comments

Post a Comment